Italy represents one of the most important countries for China’s geoeconomic interests in Europe. It is a source of strategic assets both in advanced and traditional industries and internationally recognized brands and technology as well as occupying a crucial geographic position in the framework of China’s 21st century Maritime Silk Road, an integral part of Belt and Road Initiative. Getting access to Italy’s port infrastructure is a priority for China as it seeks to expand its trading routes from the Mediterranean to northern Europe.

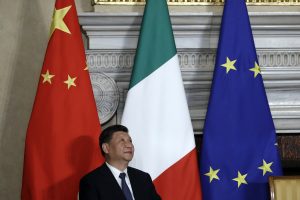

In March 2019, Italy became an official member of the Belt and Road Initiative, becoming the first G-7 country to join the Beijing led platform and the largest economy among the 15 European Union countries that are BRI members. Being the third largest economy in Europe with 15 percent of the Eurozone GDP, including Italy in the BRI was important and largely symbolic for Chinese ambitions in Europe, suggesting the growing role of China in the world. The ambitious BRI MoU signed between Rome and Beijing included 50 agreements, covering economic, cultural, and infrastructural areas. However, the anticipated economic boost for the country has yet to materialize, while fallout from getting significantly closer to Beijing amid criticism from the EU and the United States sparked a real political debate in Italy.

Italy as BRI Member: Where Are the Benefits?

Italy’s hope was that membership in the BRI would open new opportunities in trade and investment. Since the early 2000s, trade between the two countries has increased five-fold (from $9.6 billion in 2001 to $49.9 billion in 2019). However, overall trade levels between Italy and China have barely changed since 2010 ($49.5 billion). At the same time, the trade deficit for Italy has been continuously increasing, reaching $20.9 billion in 2019, while Italian exports to China have declined, dropping a 6.1 percent last year alone. In 2019, China was the third largest import partner for Italy, providing more than 7 percent of its imports, and the ninth biggest export partner, receiving just 2.9 percent of Italian exports, mainly in electronic equipment and machinery.

When it comes to Chinese foreign direct investment, Italy has been among the top three recipients in Europe, after the United Kingdom and Germany. In 2019, the cumulative Chinese FDI in Italy reached $17.4 billion (15.9 billion euros) since 2000, with the peak of investment in 2014 and 2015. If investments and construction contracts are considered, including loans, the amount of investment reaches $25.5 billion, focusing mainly on energy ($6.5 billion), transport ($8.75 billion), technology ($4 billion), and finance ($2.8 billion). Among the main investments has been the acquisition of 17 percent of Pirelli, the world largest tire-maker, for $7.9 billion by the Chinese state owned enterprise ChemChina. Chinese investors, through the People’s Bank of China, are also interested in the Italian stock exchange market, purchasing shares worth more than $4 billion in Intesa Sanpaolo, Unicredit, Eni, Enel, Telecom Italia, Generali, Terna, and others.

However, in recent years, investment has been disappointing. Italy has failed to attract many projects last year, although 29 deals were signed amounting to $2.8 billion, including deals between China Communication Construction Construction (CCCC) and the ports of Trieste and Genoa. While Huawei had announced in July 2019 a $3.1 billion investment plan over the next three years, the Italian government has since hardened its stance on China’s human rights records and on restricting Huawei Technology access to fifth generation (5G) data networks. Last December the intelligence and security committee of the Italian parliament recommended that the government “very seriously” consider banning Huawei and other Chinese equipment suppliers from Italy’s 5G mobile networks. But the response from Conte’s government was that the existing screening procedures, including the so-called “golden power rules” to protect strategic assets (covering the defense, national security, transportation, and high-tech sectors, including 5G technology), were more than enough.

COVID-19 Crisis and Its Economic Consequences

Since February 2020 the Italian economic picture has completely changed. As Italy is hampered by its most severe crisis since World War II, with more than 20,000 deaths from COVID-19, its economy will likely suffer the deepest recession in the country’s history.

The spread of the COVID-19 virus has caused an unpredictable market shock, both on demand and supply, amid the progressive shutdown of national economic activities necessary to stem the epidemic. Even before the COVID-19 crisis, Italy had been facing stagnant incomes, with the same average per capita income as 20 years ago, and its economy was struggling with a 12 percent unemployment rate and a sovereign debt worth 133 percent of GDP. The economic blow resulting from the current health disaster will bring even more dire consequences.

The Italian Institute of Statistics (Istat) notes that the consumer confidence in March alone fell by 9.9 percent compared to the previous month, and that the Economic Sentiment indicator decreased by 17.6 percent. Confindustria estimates in the most optimistic scenario a 10 percent drop in GDP in the second quarter compared to the end of 2019 and a restart in the second half of 2020, which, will however be hampered by the weak demand for goods and services. It’s estimated that Italy will end 2020 with a 6 percent drop in GDP, a 6.8 percent drop in consumption, and a 10.6 percent drop in investments.

Stock prices have plummeted. In just a few weeks, the MIB index has reached its lowest levels since 2012 with a 40 percent contraction, particularly affecting banks and insurance companies. In such a situation, many Italian companies that were in pretty good shape before the crisis now run the risk of passing into foreign hands. It seems like a repeat of what happened after the Eurozone crisis, but much worse.

And during the previous crisis, Chinese investment, mainly through acquisitions of Italian companies, went from 100 million euros in 2010 to 7.6 billion euros in 2015.

“Golden Power Rules” Extended

Worried that Italy’s distressed companies would be purchased by foreign players at cheap prices, the Italian government has quickly launched an intervention to protect national companies. As of April 8, 2020, the “golden power rules” have been extended to a wide range of sectors, including health, finance, insurance, land and infrastructure, raw materials, robotics, and media, among others.

The challenge is that protecting Italian companies from foreign acquisitions could be limited and difficult to implement in such a dire economic situation, when most companies risk bankruptcy. An intermediate solution for the Italian government could be instead their recapitalization through a public investment fund. At this stage the Italian government is taking steps to stem the most immediate effects of the crisis by providing subsidies to families, but there is no real plan for to protect businesses from bankruptcy, with only 400 billion euros in state-guaranteed loans available to companies. Other EU resources are expected to be added to these interventions in the coming days.

Small- and medium-sized enterprises (SMEs), which are the lifeline of the Italian economy, are particularly exposed and at risk. In the future we might see Chinese companies acquiring SMEs for values below 100 million euros, a trend that we had already seen in the last few years, as the investment screening guidelines do not pay much attention to small businesses. The current crisis will create even more buying opportunities for Chinese investors.

The most critical issue is the development of a strategic plan that goes beyond the emergency and stimulates the restarting of the economy, which will require a direct stimulus of public spending, and the start of large investments in the public sector. Such a program is needed to foster effects on the aggregate demand, but according to studies it will require financial assistance that unsustainable with the current debt pile of over 2.5 trillion euros.

European Response Needed

Italy is not alone in the pandemic crisis, and the entire EU will have to deal with the health and economic shocks. The coming months will be crucial to rebuild the economic fabric of the continent, not only Italy’s, and common resources will be needed. It will be a European geoeconomic issue. Debt securities guaranteed by all EU countries (Eurobonds) could be one of the tools. However, the issue of jointly guaranteed debt by all countries is only a step toward overcoming one limit of the EU institutions: the absence of joint fiscal instruments. Monetary policy is common, but fiscal policy is still the exclusive competence of individual countries.

In the era of great power competition, with growing assertive powers like China, who play out of a different playbook, and systemic problems concerning health and the environment, it is no longer acceptable not to have adequate EU economic policy instruments. Perhaps the current pandemic will be an opportunity to tackle problems that threaten the future of the EU and redefine the role of its institutions.

Dr. Valbona Zeneli is the Chair of the Strategic Initiatives Department at the George C. Marshall European Center for Security Studies.

Dr. Michele Capriati is a professor of Economic Policy at the Department of Political Sciences, University of Bari, Italy.

The views presented are those of the authors and do not necessarily represent the views and opinions of the Department of Defense or the George C. Marshall European Center for Security Studies.

This article is presented by Diplomat Risk Intelligence, The Diplomat’s consulting and analysis division. To learn more about DRI, click here.