Trans-Pacific View author Mercy Kuo regularly engages subject-matter experts, policy practitioners, and strategic thinkers across the globe for their diverse insights into U.S. Asia policy. This conversation with Ilya Spivak – Senior Currency Strategist for DailyFX and commentator in leading publications including the Wall Street Journal, MarketWatch, CNN Money, and Reuters – is the 143rd in “The Trans-Pacific View Insight Series.”

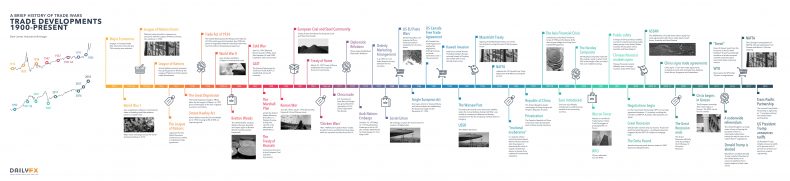

Explain DailyFX’s delineation of four unique periods in the history of trade wars from 1900 to the present.

We are looking to highlight paradigm-changing pivot points in global trade relations. The end of the Great Depression and the Second World War, the end of the Cold War, and the 2008 global financial crisis emerge as natural markers. Furthermore, the time span shortens in the more recent period as the ultimate influence of the relevant events remains uncertain.

Identify key historical events that precipitated trade wars.

Trade disputes often reflect the broader geopolitical tensions of the day. For example, the Cold War marked distinct polarization in international trade relations around the “Eastern” and “Western” bloc boundaries. When it ended, the falling away of trade barriers between its opposing sides was a major tailwind for cross-border commerce.

How might disruptive factors in history help forecast future market volatility?

Broadly speaking, price action across financial markets over the past decade reflects the monetary policy response to the 2008 global financial crisis. Its pioneering of extraordinary stimulus via quantitative easing was a direct answer to the policy shortfalls of the Great Depression. Understanding the consensus view of past crises’ causes and remedies can suggest areas of focus for future efforts. Thinking along these lines would have proven wise in the Great Recession’s aftermath were one to implement it as a strategy.

Which historical events have had transformative impact on U.S.-China trade relations?

The Korean War froze trade between the U.S. and China for two decades. The thaw was marked by U.S. President Nixon’s visit to China in 1972, with a tense but productive period thereafter building toward its [China’s] joining of the World Trade Organization in 2001. Its markets opened to foreign investors under WTO auspices soon thereafter, in 2007. Roadblocks emerged along the way, such as sanctions imposed following the events at Tiananmen Square 1989, but the overall trajectory has favored an increasingly tight-knit relationship. This has made for greater dependence as well as more direct competition.

For policymakers and market strategists, what key variables will mitigate risks of U.S.-China trade war?

The U.S.-China trade flow axis represents the central component in the supply chain accounting for a dominant share of global economic growth. The severity of fallout from a lasting disruption means that every effort is likely to be made to mend differences and avoid a standoff. That makes a forceful confrontation less likely, though not impossible. If a rupture does occur, sweeping risk aversion is likely to boost the premium on liquidity. From a policy perspective, ensuring the ability of financial institutions to withstand such stress – from generous capitalization levels to prudent capital allocation – can help cushion the blow in such a scenario. From a trading viewpoint, a swift pivot to owning liquid assets like the U.S. dollar, the Japanese yen, and Treasury bonds can mitigate damage to portfolios and sometimes even generate net profits.