The double-digit tariff hikes imposed by the United States’ Trump administration have buckled Asia to its knees. Markets have plummeted, costs have risen, and outlooks on the economic future of the region are fast approaching the dismal. There is no question that the extent of these tariffs was larger than expected. But the United States is only one player in this game, and Asia holds a few trump cards as well.

The U.S., China, and the Rest

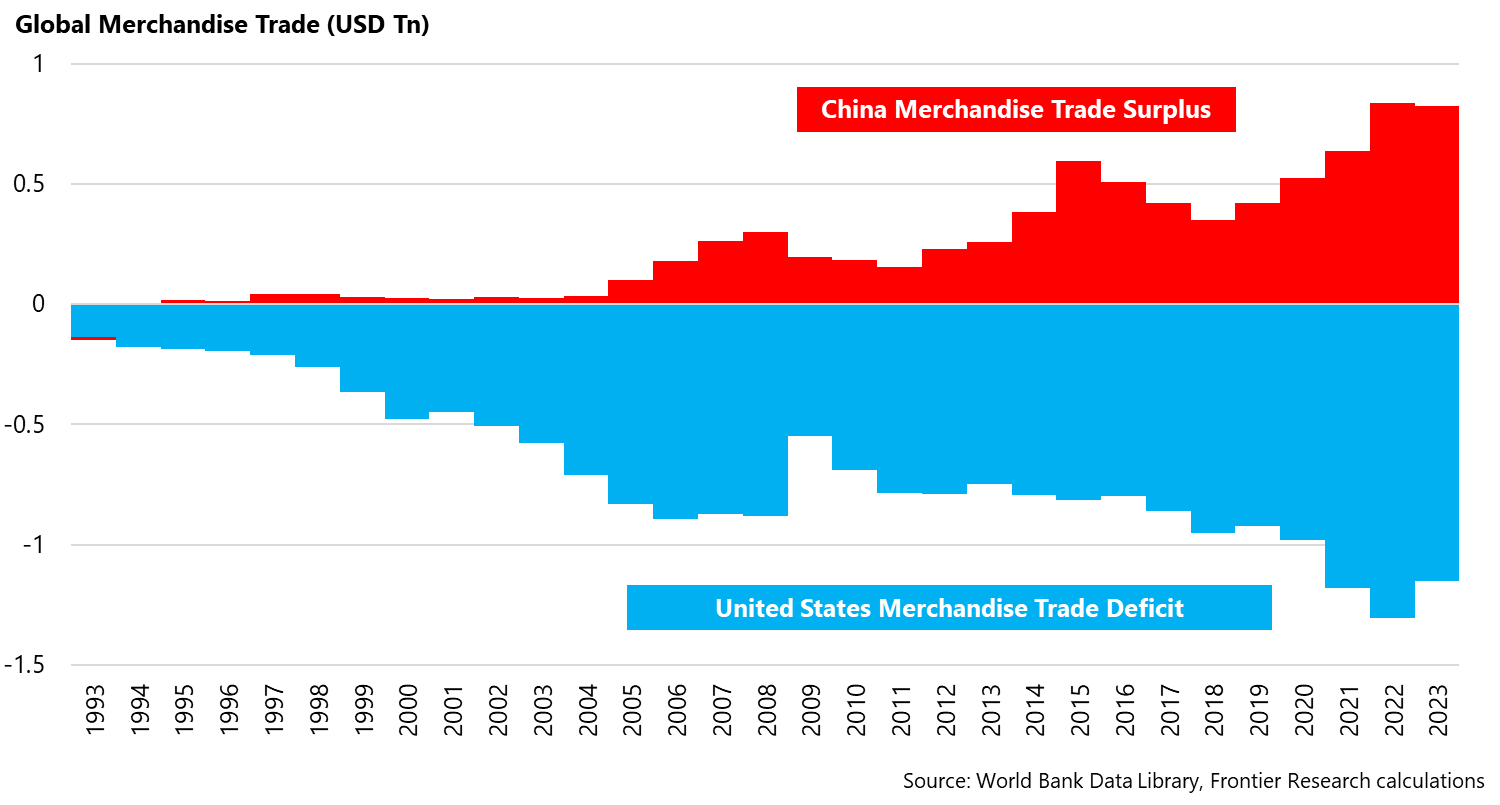

The U.S. running deficits has been a key part of the global system of trade for over 50 years now. These deficits have been countered with surpluses being run by varied countries over the years. Across the last 20 years, the major counterparty to U.S. deficits has ended up being China’s surpluses. U.S. deficits and Chinese surpluses coincide very closely, as seen in the chart below. This creates two main players in the global economy: China produces, and the United States consumes.

This system works as long as both parties agree to keep playing this game. For the United States, this means using their deep financial markets to borrow from the world, and then pay the world back in return for the goods other countries produce. Continuous increases in the U.S. deficit, and in the U.S. debt, have been the consequence.

For any other country, this would have likely resulted in a crisis far, far earlier. However, the United States holds an “exorbitant privilege” as a result of being the global deficit hegemon: they can borrow without any real cost. China coming in as the single biggest producer has helped in many ways. No longer does the United States have to deal with rising and falling surplus counterparts – China alone acts as a stable flow of capital into the U.S.

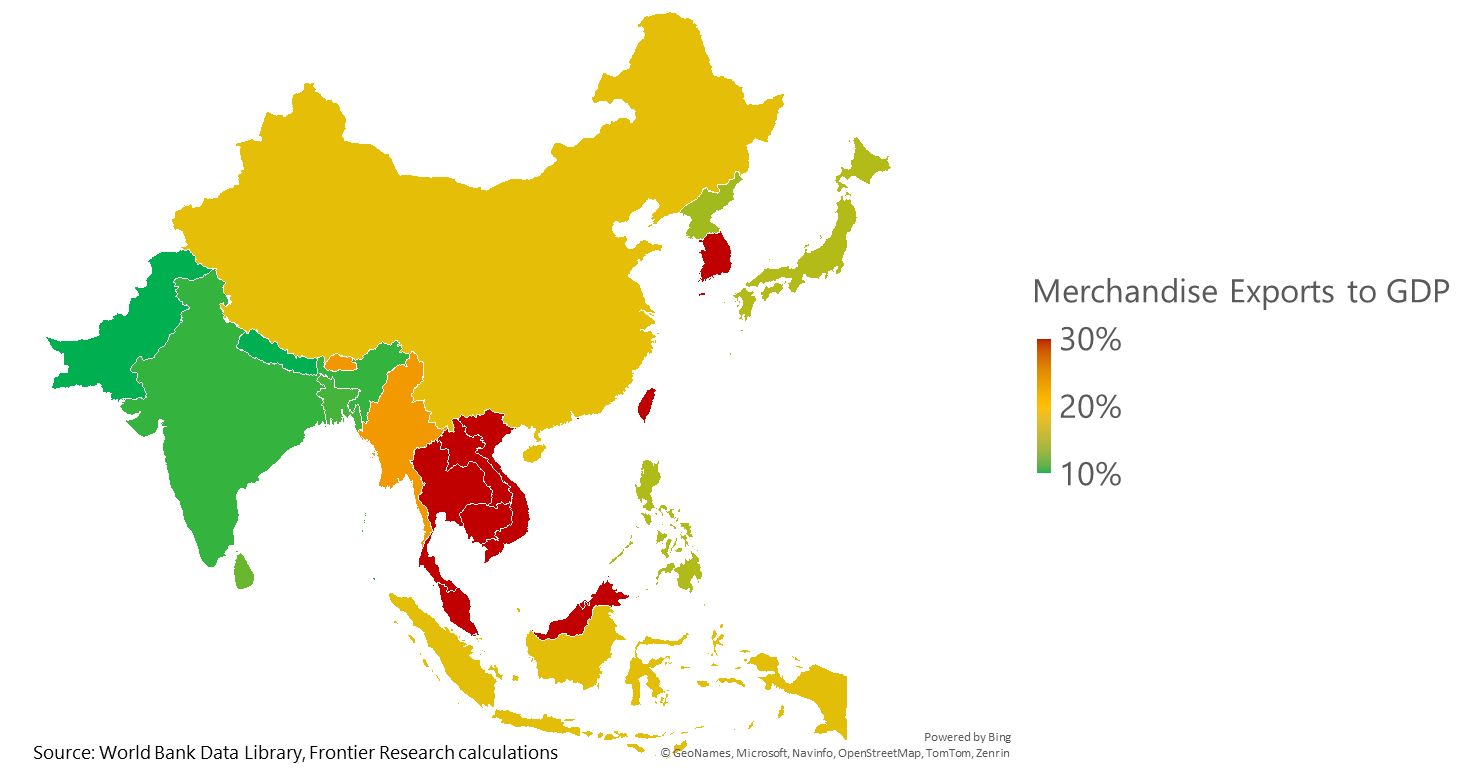

The rest of the world remains important in their own right, but in the global economy their role as an intermediary between the United States and China is arguably more critical. The rest of Asia, in particular, plays this role. Here, East and Southeast Asia combine alongside China to create a broad “Factory Asia.” South Asia plays a different role. South Asian countries do act as a slight intermediary of China-U.S. trade, but more importantly, their consuming households end up acting as an intermediary of capital.

This has been the critical reason why, even when China has reduced their direct lending into the United States, there hasn’t really been a consequence to the global system. Any surpluses that China holds have to go somewhere in the end. And regardless of who receives said capital directly from China, the end point still ends up being the United States. Nowhere else offers such safe returns at a good interest rate.

Factory Asia is a clear pathway for this intermediation. Chinese capital has flowed into the rest of East and Southeast Asia over time, building up factory capacity within these countries. Trade then flows from these countries into the United States. Even South Asia plays a critical role here, particularly because they have far larger service economies than Factory Asia – and capital cycles through them back into the larger deficits of the United States.

What Card Will China and the Rest of Factory Asia Play?

If China, supported by Factory Asia, is the clear counterpart to the U.S. deficits, then any action the United States takes to reduce that deficit will heavily impact China. The card that the U.S. has played right now is that of tariffs. For a world that has two main players, whatever China does in response – so far, enacting its own tariffs – will matter almost as much as the U.S. tariffs have.

Factory Asia has two main cards it can play, though neither is a sure bet. On one hand, Asian countries can choose to double down on their production economies and flood the world with cheaper goods. The last time around, this is what they ended up doing. For any consumer in the world, that helps quite a lot. However, this hurts other producers – and especially those that want to be producers.

On the other hand, Factory Asia can choose to stay put, close down a few factories, convince a few households to start consuming more, and try to make do within the region itself. Such a massive restructuring of the economy will almost definitely have political and social costs at home. For the rest of the world, this would create a scenario where the cheap imports they’ve gotten used to no longer exist.

Either way, whatever China and Factory Asia end up doing in response to the cards that the United States have played, the global economy will have to deal with the ripple effects. There is no U.S. deficit without the Chinese surplus, after all.

Will South Asia’s Consumers Have New Cards to Put Down?

South Asia doesn’t really have factories. Any global trade slowdown is more likely to affect the countries of South Asia through weaker services instead. If the factories of East and Southeast Asia start closing down, that might mean South Asia’s economies have to look for a better hand to play. However, if Factory Asia decides to export more, then South Asia’s households might end up being far more important to the world.

This is a pretty new place for South Asia to be in. Particularly if Factory Asia starts pumping cheap goods across the world, that makes it much harder to be a producer in South Asia. However, cheap imports and cheap capital have a benefit as well: They can really push growth. When China ramped up its production from the mid-2000s onwards, it pushed a big cycle of growth for South Asia. A rising South Asian consumer is not out of the picture here, especially if the United States deficits start closing. Someone else might need to step up.

If Factory Asia closes down, the cost to South Asia is different. No longer would trade flow across the South Asian coasts in the same way, and the service industries that have helped support the South Asian consumer might slow down. What would they do in such a context? Historically, South Asians have left their home countries, found jobs elsewhere, and sent money back for their families to spend. Will there be such jobs in a world without Factory Asia?

The Two Big Hands Will Keep Playing, and the World Will Be Watching

Over the next few months, it looks increasingly likely that the world will be playing a whole new game. In one corner, the United States is claiming its deficits are a problem. Tariffs are the card they started with. China is the other big player – you can’t play the game without them. What will they do? Which card will they play, if none of their options are great? These two hands will be the main movers that the world will have to keep watching.

How will the rest of Asia go along in such a difficult context?