The election of Donald Trump to the U.S. presidency is continuing to send shockwaves in the corridors of power across East Asia. Yet even before the results of the 2016 US elections became known, the tremors of political change in the region were already evident. Arguably, the U.S. president-elect has only added fuel to the fire of America’s relations with East Asia.

The trend in emerging rifts between a number of formerly U.S.-centric East Asian states and the Obama administration had been visible, under the radar, for several years. However, in the last few weeks and months before the American elections, there was an eruption of anti-American sentiment, principally from the increasingly populist-oriented democracies of Southeast Asia.

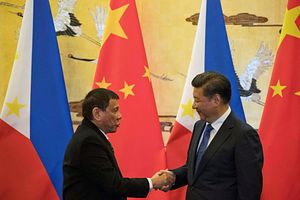

The Philippines’ Economic and Political Pivot to China

The first major political shock came when President Rodrigo Duterte of the Philippines openly declared his pivot away from the country’s longstanding relations with the United States in favor of stronger ties with China and Russia. Commonly described as the “Trump of Asia,” Duterte’s outspoken style of politics, but particularly his “war on drugs,” which has led to the extrajudicial killings of over 5,000 suspects involved in the drugs trade, has rattled many Western governments, not the least being the Obama administration. As a result, Duterte has found common ground over America’s human rights criticisms and interference in other countries’ domestic affairs with the leaders of China and Russia.

Domestic considerations aside, foremost in Duterte’s pivot was more likely the need to shift geopolitical alliances in favor of ties with China, as the world’s fast-rising superpower, given the inevitable consequences this would have for closely neighboring and much weaker countries in the region. This was manifest in China’s brushing aside the recent ruling of The Hague-based Permanent Court of Arbitration (PCA) in favor of the Philippines, dismissing China’s expansive claims in the South China Sea.

The other driver of Duterte’s pivot to China has been economic. Many of the Philippines’ largest business conglomerates, and certainly many of the country’s wealthy and powerful business owners, are of Chinese descent. Many had been progressively establishing strong business linkages with China long before Duterte came to power. It was no surprise, therefore, that during Duterte’s trip to Beijing, where $24 billion of infrastructure-related and other investment deals were agreed, top business leaders from all of the largest ethnic-Chinese-owned conglomerates in the Philippines among other business tycoons, were present.

Malaysia’s Defense and Security Swing to China

Shortly after the announcement of closer ties between China and the Philippines, Malaysia’s Prime Minister Najib Razak followed suit with a political upset by affirming closer security ties with China. To some extent, the geopolitical shift by Malaysia was not a complete surprise. The country’s relations with the United States have long been fraught with political friction. This was particularly so under former Prime Minister Mahathir Mohamad, widely renowned for his anti-Western and anti-Washington rhetoric.

That rhetoric was largely swept under the rug during Najib’s premiership. Yet his government’s relations with the United States were always somewhat guarded. One cause in explaining their reserved bilateral relationship may be attributable to the longstanding military-technical and military cooperation between Malaysia and Russia. This cooperation and improving relations, endorsed by Najib, persisted in spite of the downing of Malaysian passenger plane MH17 over southeast Ukraine, allegedly by Russian-backed rebels, in mid-2014.

Meanwhile, the growing corruption scandal over the state-controlled investment development firm, 1Malaysia Development Berhad (1MDB), which had been co-founded by Najib, coupled with the intensifying high-profile legal and regulatory pressures being applied by various U.S. authorities, are unlikely to have supported any upturn in Najib’s relations with Washington.

Not long after the scandal arose, Najib made a surprise announcement, declaring the purchase of four Chinese military naval vessels. It was Malaysia’s first such military deal with China. Its timing was controversially symbolic given the heightened tensions arising from the international spotlight on China in the wake of the PCA’s ruling against its claims of sovereignty in the South China Sea.

ASEAN’s Generally Mixed Relations With the US and China

As a matter of practice, the Association of Southeast Asian States (ASEAN) does not require its members to have a unified common foreign policy. Indeed, the principle of each state’s independent political authority is closely guarded.

For instance, Laos openly declared its close affiliation with China in early 2016. A major impetus behind this policy has been Laos’ enthusiasm to attract large-scale Chinese infrastructure investment under its Belt and Road Initiative (BRI) linking Asia to Europe.

Cambodia has similarly been drawn to China given its offers of significant infrastructure investments and loans. The relationship between the two became even closer in October 2016, when President Xi Jinping visited Cambodia’s Prime Minister Hun Sen. In turn, Hun Sen has described China as his country’s “closest friend.” As a sign of their growing relations, Cambodia recently vetoed an ASEAN statement referring to the PCA ruling against China’s claims in the South China Sea. Furthermore, Beijing’s economic and international support for Cambodia in the face of a reported clampdown on opposition to the ruling party has strained Cambodia’s relations with the United States and Europe, which have seen a loss of leverage over the country’s exercise of human rights.

ASEAN’s other states have typically implemented foreign policies that tend to favor a balance of relations with global superpowers. Vietnam has been the main country in the region to vociferously oppose China’s growing influence there, particularly in light of recent clashes over a number of features where the two states have overlapping claims in the South China Sea. As a result, Vietnam’s wariness in regard to its powerful regional neighbor has spilled over into developing warmer ties with its former adversary, the United States. Having said that, Vietnam’s ongoing economic and political relationship with Russia, including in its military relations, will probably continue to underpin the country’s main foreign policy agenda, notwithstanding Russia’s growing relations with China.

Ever since Thailand’s military junta took power, political and economic relations with the United States and Europe have been increasingly problematic. As the military rolled back democracy in their constitutional re-write, the leanings toward more centrist and authoritarian forms of government, even after possible elections to be held in 2017, would see considerable power continue to be wielded by the generals. In this political vacuum, where the United States and Europe have downgraded relations with Thailand, the military government has fostered stronger ties with China, especially in relation to arms deals, but also in trade. China has become Thailand’s largest trade partner, having recently overtaken Japan.

In Myanmar, the appointment of Aung San Suu Kyi in April 2016 to the position of the country’s state counselor (de facto prime minister), in addition to her party’s overwhelming majority in parliament, has shifted the country’s fledgling democracy away from its military-dominated government’s traditional links with China and toward strong relations with the United States and Europe. Even so, Suu Kyi’s first official overseas visit, in August 2016, was to Beijing, before then visiting the United States. Her visit to Beijing was essentially in recognition of the important role that China will likely have for Myanmar’s economy. On this point, Beijing will strive to maintain influence in its strategically-positioned southern neighbor by investing extensively in BRI-related infrastructure and energy across the country, as well as fostering closer political relations with Suu Kyi’s government.

Singapore and Indonesia — ASEAN’s wealthiest and largest economies, respectively — have maintained constructive ties with the United States over many years. At the same time, both have increasingly engaged with China, especially on the economic front, while also affirming closer political ties in the context of their ongoing relations with the Washington. How this balance of relations is managed in the face of a potentially-protectionist Trump presidency amid ever expanding trade and investment relations with China, which is already their main partner in each respective economic sector, remains to be seen.

South Korea’s Foreign Policy Uncertainty

In the wake of Trump’s election victory, the typhoon of geopolitical change, which started in Southeast Asia, has begun to drift upwards into Northeast Asia, most especially in the direction of South Korea. A gathering political storm there has engulfed the country’s President Park Geun-hye, who was impeached by the National Assembly on December 9. Park has been removed from office pending confirmation of her impeachment by the Constitutional Court.

The mounting scandal embroiling many of Korea’s largest chaebols and a confidante of the president herself has involved both corruption and abuses of power. For the vast majority of the Korean population, increasingly squeezed by economic pressures, the country’s political and economic ruling elite, largely founded by Park’s late father, the military ruler Park Chung-hee, have become a symptom of the country’s decline.

By coincidence, only a few months before the uncovering of this all-consuming political scandal, Park undertook the controversial policy of stationing the U.S. Terminal High Altitude Area Defense (THAAD) anti-missile system in South Korea. Initially, most of the country supported the policy, seen as a necessity to mitigate the threat of North Korea’s nuclear weapons program.

However, the policy was increasingly subject to criticism by Beijing, which voiced its concerns that the system’s radar would be able to track the movements of Chinese weapons. Beijing progressively raised the levels of its warnings, including the prospect of a regional arms race that could destabilize the region.

Since China’s (and Russia’s) growing criticisms of the THAAD deployment, and in parallel with the rising political scandal, the main opposition has become increasingly vocal saying they would campaign for scrapping the THAAD deployment as one of their policy platforms during the upcoming presidential election. If so, this would be the first occasion that a mainstream political party would have campaigned on a split with the United States over defense policy.

Furthermore, the success of the main opposition party in this year’s parliamentary elections, leading to the first loss of Park’s ruling party’s parliamentary majority in 16 years, has elevated the likelihood that a mainstream political party will be empowered to shift away from Seoul’s traditionally close cooperation with the United States on foreign and defense policies. As a sign of things to come, this has even led to members of the opposition calling for an independent policy against Washington by removing some sanctions on North Korea.

Conclusion

The foreign policy direction now taking root in parts of East Asia, in terms of pivoting away from the United States and toward China and even Russia, to a lesser degree, may be characterized as a case of falling dominos in parts of Southeast Asia. The Philippines and Malaysia have joined states like Thailand, Laos, and Cambodia in embracing China and holding the United States at arm’s length.

Meanwhile, in Northeast Asia, the decline of South Korea’s traditional ruling elite, tied in with a mainstream political opposition more willing to embrace a foreign policy relationship with China over North Korea, clearly sets out a more complex range of outcomes. The U.S. position in East Asia looks shakier than even before, and President Trump is not even in office yet.

Bob Savic is a Senior Research Fellow at Global Policy Institute, London Metropolitan University and a Partner in Eurasia Corporate Services, St. Petersburg Capital Management LLP.