On February 13, the Kishida government made a Cabinet decision on the Hydrogen Society Promotion Bill as well as the Carbon Capture and Storage (CCS) Business Bill in order to financially support operators of hydrogen, ammonia, and CCS technologies. It is highly likely that the two bills will be enacted by the end of the current ordinary Diet session, and the legislation will be implemented within this year, possibly as early as this summer. Needless to say, this legislation is designed to achieve Japan’s decarbonization goal as well as green transformation (GX) strategy in accordance with the 2015 Paris Agreement.

The CCS Business Bill plans to develop an environment where operators can smoothly begin their CCS businesses by 2030. Under the new permission system, the Ministry of Economy, Trade, and Industry (METI) shall grant permits to CCS operators after the designation of specific areas for carbon capture and storage. CCS operators that plan to open businesses in these areas would also need to obtain permission from the Ministry of the Environment.

Moreover, specific plans for excavation and storage would need to be approved by METI and the business plans should be approved by the Ministry of the Environment. CCS operators will be obliged to monitor the temperature and pressure of the site to check for any leaks of carbon dioxide from the storage reservoir. CCS operators would be able to transfer these monitoring operations to the Japan Organization for Metals and Energy Security (JOGMEC) as long as the operators satisfy certain criteria.

Importantly, CCS operators will be responsible for liabilities related to excavation and storage businesses, regardless of intentions. This “no-fault liability” is designed to save possible victims in the event of accidents deriving from CCS businesses.

Previously, Japan selected seven CCS projects to promote commercialization of the technology in June 2023. The seven role model advanced CCS projects, announced by the state-owned JOGMEC, are composed of five domestic projects and two overseas projects.

The five domestic CCS projects are:

- A project in the Tomakomai area of Hokkaido developed by Japan Petroleum Exploration (JAPEX), Idemitsu Kosan, and Hokkaido Electric Power Company

- A project in the Tohoku region’s west coast promoted by Itochu, Nippon Steel, Taiheiyo Cement, Mitsubishi Heavy Industries, Itochu Oil Exploration, INPEX, and Taisei Corporation.

- A project in the East Niigata Area developed by JAPEX, Tohoku Electric Power Company, Mitsubishi Gas Chemical Company, Hokuetsu Corporation, and the Nomura Research Institute.

- The Metropolitan Area CCS project promoted by INPEX, Nippon Steel, and Kanto Natural Gas Development.

- A project in northern to western Kyushu developed by ENEOS, JX Nippon Oil & Gas Exploration Corporation, and Electric Power Development (J-POWER)

These are the main hubs of advanced CCS projects in Japan.

JOGMEC also selected two overseas projects for promotion. Because possible reservoirs in Japan are limited, Japan needs to find overseas places to store carbon.

The Offshore Malay CCS project aims to transfer carbon dioxide emitted by multiple industries, including chemical and oil refineries, in the Kinki and Kyushu regions to an area off the east coast of the Malay peninsula in Malaysia. Mitsui & Co. has invested in this project.

Under the Oceania CCS project, carbon dioxide emitted from multiple industries including steel plants in the Chubu region (Nagoya and Yokkaichi) would be stored in the Oceania area. This effort is promoted by Mitsubishi Corporation, Nippon Steel, and ExxonMobil Asia Pacific Pte.

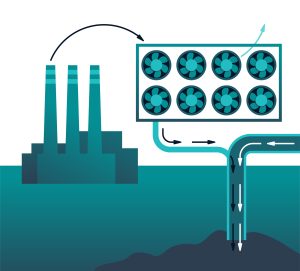

The draft legislation for CCS businesses and the selection of these advanced CCS projects both indicate that the Japanese government has been strenuously committed to the development of CCS projects toward the carbon-neutrality goal. On top of that, CCS technology is vital for production of “blue hydrogen” or “blue ammonia,” which has been regarded as low-carbon energy, and is currently cheaper than carbon-free “green hydrogen” or “green ammonia” derived from renewable energy. That said, CCS technology is not 100 percent precise and a certain amount of carbon dioxide can be leaked in the CCS process. Even so, blue hydrogen is considered much cleaner than “gray hydrogen” or “gray ammonia” made by fossil fuels without the CCS process.

For this reason, however, Japan’s blue hydrogen project in the Australian state of Victoria has not been approved by the Victorian government, despite the fact that both the Japanese and Australian governments have supported the bilateral low-carbon hydrogen project by the Suiso Frontier project. As a matter of fact, Victorian Energy Minister Lily D’Ambrosio has challenged Japanese companies to “prove they can capture the carbon they plan to liberate from La Trobe Valley coal when making hydrogen.” She added: “What’s really critical here, there’s a really important threshold test, and that is: can they capture the carbon from the coal.”

The disapproval of the blue hydrogen project by the Victorian government is a reminder that CCS technology is not regarded as reliable at this stage. Of course, CCS should not be used for so-called greenwashing. That said, CCS is a critical piece of the low-carbon puzzle, especially as the nascent hydrogen and ammonia industries continue to develop.

Terazawa Tatsuya, chairman and CEO of the Institute of Energy Economics, Japan (IEEJ), has warned that “project delays put Australia’s Japanese hydrogen hopes at risk.” He added, “I sincerely hope that effective measures will be put into place in time to improve the attractiveness of Australian hydrogen.”

Despite the technological difficulties, CCS has been globally supported by many countries around the world. Showing its firm conviction in the potential of CCS, the United States supported blue hydrogen and blue ammonia projects based on CCS in the Inflation Reduction Act (IRA). Likewise, the Australian government has continued its financial support for CCS, although there is opposition and concern over the technology inside the country.

In Europe, the United Kingdom, Norway, the Netherlands, and Belgium are promoting CCS. In Asia, China, India, Indonesia, Malaysia, Thailand have been supportive of the technology, although both China and India used to be skeptical of CCS. In the Middle East, Saudi Arabia and the United Arab Emirates have invested in and supported CCS technology.

Again, it is true that the current CCS technology is not perfect, but it could be improved by technological breakthroughs in the future. For example, Microsoft co-founder turned philanthropist Bill Gates has invested in the production of “turquoise hydrogen” created through the pyrolysis of natural gas, generating both hydrogen and solid carbon, rather than carbon dioxide. Meanwhile, Tesla and SpaceX CEO Elon Musk has invested in “direct air capture” (DAC) technology, by which carbon dioxide can be directly captured from the air.

This level of technology might seem like a fairy tale, but the Japanese government, in collaboration with other governments and investors, has sought to facilitate such technological breakthroughs as part of the overall path toward carbon neutrality.

As part of Japan’s decarbonization strategy, CCS technology is and will remain indispensable for the hydrogen-making process, a key part of Japan’s progress toward the goal of carbon-neutrality as well as fulfilling the Paris Agreement. The CCS Business Bill, expected to be enacted within the current Diet session, paves the way for commercializing this technology.