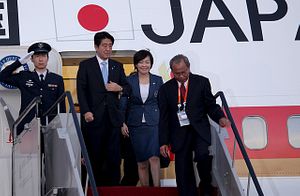

Japanese Prime Minister Shinzo Abe has finished his five country tour of Latin America this weekend in Brazil. Beginning in Mexico on July 25, Abe also visited Trinidad and Tobago, Colombia and Chile before winding up his visit in what was expected to be his most fruitful stop for deals on trade and investment. While traveling with nearly 70 chieftains from corporate Japan, Abe used this latest foray abroad to both sign new deals and solidify old relationships. Traveling on the heels of Chinese President Xi Jinping’s visit to the region, Abe sought to provide a Japanese alternative to China’s now much deeper pockets, offering greater technical expertise as well as touting his economic reforms, which could possibly offer greater access to Japanese markets in areas such as agriculture.

At the end of his trip, Abe had logged visits to 47 countries since assembling his second Cabinet in December 2012. He is now the second most travelled Japanese prime minister behind Junishiro Koizumi, who visited 48 countries in his five-and-a-half-year tenure. Additionally, Abe is the only prime minister in the last ten years to have visited Central and South America, a reflection not just of the region’s natural resources, but with a combined population of roughly 600 million its increasing appeal as a market for Japanese exports.

After successfully lining up energy and infrastructure deals in Mexico, and similar small-scale deals in Trinidad and Tobago, Abe moved onto strike two significant and symbolic agreements in Chile and Colombia. In Colombia, Abe signed an agreement with President Juan Manuel Santos to “accelerate negotiations” toward signing a free trade agreement. Once signed, Japan would have FTAs in place with all four members of the Pacific Alliance (Mexico, Peru and Chile are the others). Santos called Japan his country’s “most important Asian investor,” while Abe signaled that Japanese firms would help build the country’s fiber-optic network. With bilateral FTAs with all the members of the Pacific Alliance, Abe pledged to execute deregulation as part his economic structural reforms, seen as a hint at the opening up of Japan’s highly protected farming sector to competition from its trade partners.

Visiting Chile on Thursday, Abe and President Michelle Bachelet signed deals emphasizing Japanese investment and technology transfer. Bachelet told Abe she wanted him to see Chile as “a great partner and an enormous entryway to the Latin American region.” Abe attended the opening of the Japanese financed Caserones Copper Mine, which is capable of meeting 10 percent of Japanese demand for that commodity. Japanese companies will also help Codelco, Chile’s national copper company, to develop more efficient and sustainable mining technologies, and Japan’s government has agreed to transfer its technological expertise on earthquakes and tsunamis (natural disasters both countries are intimately familiar with).

Finally, Abe’s visit to Brazil did not disappoint either country’s investors, with agreements signed across a spectrum of industries. Japan has proposed the export of megafloats to help Brazil develop its offshore oil fields, an investment that would reportedly cost 50 billion yen ($487 million). Abe also announced that a Japanese company will also likely win a contract to build a new subway line in Sao Paolo, an area in Brazil with a large Japanese immigrant population. In addition, the two sides discussed joint exploration of coal and mineral deposits as well as Japanese financing to increase soybean and corn production. The last area of their trade talks concerned a memorandum of understanding on medical and health care services, intended to shorten the time it takes for Japanese medicine and equipment to be available in Brazil. This last deal will be increasingly important for Japan in the future as its own health care industry rapidly expands with its aging population. Additional markets abroad will help keep this industry sustainable once Japan’s own market begins to shrink.

In a sense, Japan is now playing catch up with China in Latin America. While Abe is pushing for a greater Japanese business presence in places like Brazil that already have a large ethnic-Japanese population, China has been investing heavily in the region for quite some time. China is already Brazil’s largest trading partner and its exports to that country are already five times greater than those to Japan. Japan does have technological and qualitative advantages in areas like rail, energy, infrastructure and medicine that its companies will use to carve out their own investment empires in this region. However, possibly the greatest gain to be had for Japan in Latin America would be to join a large multilateral trade agreement like the Trans-Pacific Partnership. Some of the companies in its own protected and relatively unproductive sectors (particularly agriculture) would be displaced, but price benefits to consumers would do much to ameliorate the effects. Additionally, the competition would help to shake up industries that have languished for decades without having to innovate or adapt to modern markets.