The Japan-South Korea trade friction revealed that Korean companies, even though they have dominated the semiconductor market for many years, still need Japanese suppliers in the semiconductor industry. That means Japanese companies can easily exert pressure on the Korean giants. Has the world been underestimating Japan’s companies – not to mention the country’s economic strength and technological innovation? What can we learn from “Made in Japan”?

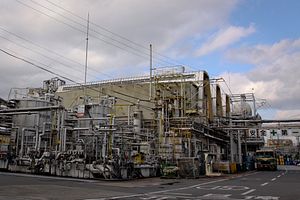

Above all, Japanese companies have abundant technical ability and technical reserves. There are many semiconductor giants in Japan. For example, Shin-Etsu Chemical Co., Ltd., which founded its business selling nitrogen fertilizer in 1926, specializes in the research and manufacturing of basic materials to meet market demand. It has even monopolized the crucial raw material market within the semiconductor industry today. Currently, Shin-Etsu Chemical is the world’s largest supplier of silicon wafers and the largest silicone products manufacturer. The company is able to produce a uniform crystal structure of single-crystal silicon with a purity of 99.999999999 percent, which places it at the world’s leading technology level.

Shin-Etsu Chemical is not alone, however. Although Japanese manufacturing companies are gradually fading out in downstream industries — such as home appliances, smartphones and others — they still play key roles in upstream industries, including indispensable chemical and electronic materials, spare parts, and precision equipment, among others. According to a survey conducted in 2018, Japanese companies ranked first in market share in 11 out of 74 target categories, including digital cameras, composite machines, motorcycles, CMOS (complementary metal-oxide semiconductor) image sensors, polarizers, lithium batteries for mobile phones, and others. Many of these parts are used in smartphones. Japanese companies such as Sony still continue to supply a wide range of key components, including touch screens and cameras, to smartphone makers. A Japanese research company disassembled the Apple iPhone XS Max and found that 13.5 percent of the parts were made in Japan. In addition, three Japanese companies, Toray, Teijin, and Mitsubishi Chemical, control nearly half of the global market in aircraft manufacturing materials, according to Japanese media.

Made in Japan is also found in many less visible but vital areas. For example, Japan produces 80 percent of the world’s precision small motors. Seiko has a global share of nearly 40 percent in bearings production while YUKI Precision is a small firm that produces precision gyroscopes that can be used in small satellites. What is noteworthy is that Japan’s Ministry of Economy, Trade and Industry (METI) has specially designated a dozen specific manufacturing basic technologies, all in the hands of small- and medium-sized enterprises. Japanese media called these companies “small but beautiful.” Some Japanese manufacturing companies have dug deep into their traditionally advantageous fields and are currently striving for global excellence.

Moreover, following the principles of diversification and not putting all their eggs in one basket is another common idea among Japanese companies. Toyota, for example, Japan’s largest automaker, is shifting from being an automaker to being a provider of “mobility services.” Panasonic sold off its Sanyo white goods units as early as 2012. At present, apart from a small part of the home appliances business, Panasonic’s main business forms are environmental solutions, automobiles, and consumer electronics, etc.

From the historical perspective, we can see the peak and evolution of Japanese manufacturing development. Take semiconductors as an example. Before the 1990s, Japanese companies not only occupied the upstream of the industrial chain, but also led the whole industry chain. In 1990, Japanese semiconductor companies accounted for six of the top 10 semiconductor companies in the world. However, since the beginning of this century, Japan’s semiconductor industry has declined amid U.S. pressure and international competition. As of 2019, only one Japanese semiconductor company – Toshiba – was ranked among the world’s top 10.

The difficulties faced by Japanese companies are real. Despite Japanese manufacturing remaining competitive in some sectors today, repeated quality and management problems inevitably give the impression that the aura of this manufacturing power is fading. According to Yuichi Washida, a scholar at Hitotsubashi University, Japanese manufacturers have suffered “four straight defeats” since the late 1980s in the competition for international standards in software, integrated circuits, internet, and mobile networks.

The image of “Made in Japan” was once the embodiment of Japan’s innovative capacity. What changed for this former big innovative power in the past few decades? The reasons behind the shift may be technological progress, industrial relocation, market competition, and others. More importantly, however, it may perhaps be the fact pointed out by Chen Gong, chief researcher at ANBOUND, that Japanese companies have adjusted their strategies and industrial development direction in the face of market competition.

According to Chen, judging from the latest changes in Japanese companies, the key strategy for the Japanese manufacturing industry to remain competitive now is “from integration to zero,” which charts a new path for the Japanese manufacturing industry in the global manufacturing chain. Other manufacturers seeking to expand their businesses try to cover the entire industrial chain, which seems to be an ideal competitive strategy. However, the Japanese manufacturing industry is now taking a different strategy — many Japanese companies have withdrawn from the businesses of taking charge of the whole machine, which includes system, branding, and marketing. For instance, Toshiba and Sanyo have long since withdrawn from the whole machine business, but they have grasped the key components market and thus realized the strategy of getting “from integration to zero.”

What is unique about this strategy is that while other people are marketing their brands to the public, Japanese companies only focus on the production of high-quality core components, which are a crucial part of the entire industrial chain. The resulting profit margin may be higher than in a business model that covers the whole industrial chain. As the world gradually shifts to a consumer society, the world has entered an era of fierce market competition. But no matter which company’s brand wins the market, the core components of Japanese manufacturing are indispensable and Japanese companies will thus guarantee their own stable market.

The new path of Japanese manufacturing shows that there are many patterns of market competition, and those which are indispensable in the fierce competition for market space will emerge as the real winners. This is the “truth” behind the competitiveness and evolution of Japanese manufacturing in recent years. This kind of competitive strategy, technical ability, having an industrial system in which a large number of “small but beautiful” companies participate, as well as the “fine manufacturing” spirit demonstrated by Japanese manufacturing industry, are all worthy of notice and study by China’s manufacturing and policy sectors.

He Jun hold a master’s degree in the Institute for the History of Natural Sciences, Chinese Academy of Sciences, majoring in intellectual history of science, and is a senior researcher at Anbound Consulting, an independent think tank with headquarters in Beijing. Established in 1993, Anbound specializes in public policy research.