The year of the metal rat (2020) officially starts on January 25. The rat is the first zodiac sign of Chinese astrology, and for this reason, many consider 2020 a year of renewal. The metal rat, in particular, is known to turn unfortunate events into fortunate ones. The zodiac characterization coincidentally fits well with this lunar year’s forecast. China will try to arrest and further mitigate the setbacks of 2019, regroup and reset in 2020, and then get back on the path of national rejuvenation when the strategic environment becomes favorable again. For Beijing, it is about the long game.

Constraining Trade War

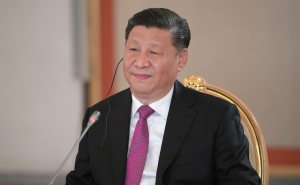

The United States and China signed the “Phase One” trade deal on January 15, and U.S. President Donald Trump and Chinese General Secretary Xi Jinping will meet later to kick off negotiations on the next phase of the agreement. Until the trade talks conclude with a mutually acceptable and enduring “final” deal, Beijing’s actions will be tempered and measured. Xi will mostly refrain from making any provocative act(s) that could upset the ongoing delicate negotiations.

The only exceptions are issues like Hong Kong, Taiwan, and perhaps the South China Sea (SCS), which can undermine China’s national sovereignty, the Chinese Communist Party’s (CCP’s) political legitimacy, and Xi’s popular support.

If the Hong Kong protests persist and escalate to an unacceptable level, Xi will quickly direct his new top representative – Party stalwart Luo Huining – to take all necessary measures to restore law and order, to include deploying and employing more mainland security forces and enacting Article 23 of the Hong Kong Basic Law.

Although Taiwanese President Tsai Ing-wen overwhelmingly won a second term on January 11, Beijing will likely continue coercive pressures across the diplomatic, information, military, and economic domains to isolate Taiwan and undermine the Tsai administration. China has taken an especially hardline stance against the independence-leaning Tsai since her 2016 inauguration. Beijing remains infuriated by her refusal to accept the “one country, two systems” model and 1992 Consensus. If Tsai makes any movement toward independence, Xi will certainly take decisive actions to preserve China’s territorial integrity.

Encouraged by Vietnam’s role as the 2020 Association of Southeast Asian Nations (ASEAN) chair and its strong response to Chinese encroachments into its exclusive economic zone last September, Indonesia, Malaysia, the Philippines, and other ASEAN countries are pushing back in the SCS and pressuring Beijing on the SCS Code of Conduct, set to finalize negotiations in 2021. If the regional pushback intensifies, gains momentum, and threatens China’s gains in the SCS, Xi will quickly step up efforts to again divide and splinter ASEAN but avoid any provocative act that could invite a U.S. or multilateral response. He wins by merely maintaining the status quo in the SCS.

Strategic Inflection Point

If the United States and China reach a final trade deal (not a foregone conclusion), the restraining shackles will be off and Xi will again be unencumbered to act. However, China will then be at a strategic inflection point. Xi will have to decide whether or not to double down on China’s assertive activities in 2018 to openly challenge U.S. regional influence and global preeminence. Alternatively, Xi could choose to tone down the political rhetoric and public diplomacy and scale back the forceful actions. China could once again “temporarily” assume a lower profile per Deng Xiaoping’s iconic dictum of “hide our capacities and bide our time, be good at maintaining a low profile, and never claim leadership.”

For now, it looks like Xi will choose the latter despite the political and popular backlash from some quarters of the CCP and some segments of the Chinese populace. Just like last year, Xi probably believes that China took two steps forward in 2017 and 2018, and must now take one step backward in 2019 and 2020 before moving forward again in the coming years when the strategic conditions become favorable. The backsteps are necessary if he is going to keep the all-important Chinese economic engine running on all cylinders. Xi will likely focus on domestic issues and internal stability for the next 12 months. He will try to finalize a favorable trade agreement with the United States, stabilize the weakening economy, meet several stated economic milestones before the 2021 centenary of the CCP’s establishment, and contain the ongoing (African swine flu) and emerging (Wuhan coronavirus epidemic) health crises. The swine flu is a big deal for Beijing. Pork makes up 60 percent of Chinese meat consumption, and China may have already lost half of its 400 million pigs to the disease. Beijing has had to tap into its national strategic pork reserve to meet the high demand and control the record high prices, particularly ahead of the upcoming lunar year celebrations.

The Xi Factor

An examination of key Chinese official public statements, authoritative media reports, and think tank analyses suggest Beijing will look more inward, maintain the status quo outward, and only act when red lines are crossed in 2020. If so, the objectives are to bide and buy time; preserve past gains; lull the United States, region, and the world into a false sense of security; marshal China’s resources for recapitalization; strengthen the economic, political, and social foundations for national resiliency; rally the populace for the long fight or struggle; and where possible, stabilize the U.S.-China relationship – return to the status quo, or at the very least, minimize the impact of any status change.

Xi may be another unwitting raison d’être for the transitory Chinese retrenchment. He gambled and miscalculated badly in 2019. He poorly managed the costly trade dispute and the all-important bilateral relationship with the United States. He misjudged Trump’s resolve and commitment, bipartisan U.S. Congressional backing, and U.S. popular and international community support. He cornered himself into a difficult personal and political dilemma – either protect his carefully cultivated aura of political invincibility and preserve national and personal pride or give up ground and avoid a punishing, protracted trade war. If he chose the former, he risked long-term economic fallout and put at risk the much-cherished Chinese Dream that he has embraced as his own. If he chose the latter, he opened himself up to easy criticism by his political opponents for conceding too much to Washington. Either way, the stakes are high for Xi.

China’s relationship with the United States is its most important, and if the bilateral ties are mismanaged, it could damage China’s economy and undermine Xi’s standing within the CCP as well as his political authority and legitimacy with the Chinese people. If taken in this context, the latest string of events – Xi’s new special title elevating his status to that of Mao Zedong, more domestic press reporting lauding Xi’s leadership and accomplishments, off-cycle promotion of 100 generals, rare bureaucratic shake-up, increased domestic censorship, and expanded public diplomacy – may be indications of Xi’s political weaknesses. If so, they are indirect efforts to shore up his waning political power and encouraging signs of his willingness to work with Washington at least in the near term.

Things to Watch For

With or without retrenchment, China’s explicit and implicit strategic objectives remain unchanged from last year. Beijing will challenge U.S. regional influence, global preeminence, and the liberal international order. China will expand and protect its political and economic interests through sharp power and predatory economic practices. Beijing will pursue new diplomatic and economic partnerships via the Belt and Road Initiative (BRI) and widen and deepen its security influence along the BRI. China will further develop its capabilities and capacities and bolster the international standing of the PLA to become a military superpower. Beijing will increase and enhance its global military access through potential basing options in Asia, the Middle East, Africa, Europe, Latin America, Oceania, and Antarctica. Finally, China will advance its capabilities, capacities, and postures in the interconnected domains of cyberspace and space, particularly the latter since the United States now has a Space Force. Altogether, Xi will do all of the above in 2020 but more subtly, cautiously, incrementally, and as its weakening economy permits.

The challenge to the liberal international order (LIO) warrants closer scrutiny in 2020 and beyond. This strategic objective has evolved through the years from merely pushing back against the Western-oriented global order from the outside to now changing the extant norms and rules in Beijing’s favor from the inside. Many Western policymakers wrongly assumed for decades that the liberalization of China’s economy would eventually be matched by a similar liberalization in the country’s political structure and full integration into the LIO. Quite the opposite. Beijing did not embrace the liberal values on which the system was based. Instead, it did not comply with the World Trade Organization rules, promoted alternative institutions like the Asian Infrastructure Investment Bank, and undermined the global rules and norms as it transforms its growing economic and military powers into raw political power.

Many Chinese political theorists and pundits now assert that the LIO has not kept pace with the economic shift toward the Indo-Pacific, where three of the world’s top five economies currently reside – China, India, and Japan. The region’s combined gross domestic product (GDP) exceeds that of the United States and the European Union. This new economic reality calls for long-overdue reforms at the International Monetary Fund (IMF), World Bank (WB), and United Nations Security Council (UNSC), which have been dominated by just a few, mostly declining powers. Lastly, Beijing has been increasingly questioning the U.S. dollar’s dominant role as the leading international reserve currency and advocating for an alternative currency with the long-term goal (hope) of the renminbi being that global money of choice.

The emerging China-Russia alliance also bears close watch in 2020 and beyond. Beijing and Moscow have a long and uneasy relationship that often has been tense despite a shared communist pedigree, long history of arms trade and military technology transfer, and similar voting records within the UNSC. 2019 saw a marked increase in bilateral and multilateral military exercises that underscore closer ties and a growing alliance of convenience to counterbalance the United States. Last December, China, Russia, and Iran conducted a four-day joint naval drill in the Indian Ocean and Gulf of Oman. The People’s Liberation Army Navy joined its Russian and South African counterparts in a joint exercise near Cape Town, November 25-29. In September, Russia carried out a series of large-scale military drills with China, India, and Pakistan as part of its annual Tsentr exercise in Central Asia. China and Russia conducted a six-day joint naval exercise, codenamed Joint Sea 2019, in the Yellow Sea, April 29 to May 4. The coming year will reveal how deep this developing alliance goes and how far Beijing and Moscow are willing to challenge Washington in great powers competition.

Guiding North Star

Beijing will never abandon its national goals and global ambitions. China may, on occasion, slow down or take a small course deviation, but it will always eventually return to its guiding North Star – the expansionist Chinese Dream. The next opportunity to do so may be the 2020 U.S. presidential cycle, which brings with it the possibility of a new administration with new priorities and new opportunities that China can shape in its favor. If not, Beijing needs a contingency strategy and policy for the next four years.

Tuan Pham is a Navy Captain, student of the College of Naval Warfare, and fellow with the Gravely Group Advanced Research Program and Arleigh Burke International Program at the U.S. Naval War College. The views expressed here are personal and do not reflect the positions of the U.S. Government, U.S. Navy, or U.S. Naval War College.