This month’s coup in the West African nation of Guinea was the third coup in two years on the African continent – two years that have also been marred by the threat of COVID-19 and poor vaccine access.

In his address, the coup leader Lt. Colonel Mamady Doumbouya announced the dissolution of President Alpha Conde’s government and suspension of the constitution. Doumbouya accused Conde’s government of endemic corruption and “trampling on citizen rights.” Joy on the streets of Conakry followed Alpha Conde’s arrest, similar to the reaction after the Mali coup that ousted President Keita.

However, unlike the other two coups in Mali and Chad, Conde’s ousting caused a significantly stronger reaction from afar, including from China.

Institutional outrage and condemnation flowed in from Nigeria, and France called for the immediate release of Conde. The U.N. secretary general joined in strongly condemning the coup as did the African Union and the Economic Community of West African States (ECOWAS), with both organizations suspending Guinea’s membership. The commodities market also reacted and aluminum prices traded at their highest rate in about a decade. Panic headlines were seen – such as “Guinea coup rattles iron ore and bauxite markets, stokes economic uncertainty” by CNBC or ”Guinea’s top minerals at risk after coup” by Reuters.

A rapid response from coup leaders was necessary. The fact is, Guinea is highly dependent on its international commodity exports. It is a major source of bauxite, from which aluminum is processed, and home to the Simandou range – the largest untapped iron ore deposit in the world with an average of 65 percent iron content. Guinea is also a source of gold deposits. China accounts for 16 percent of Guinea’s exports, earning just under $600 million every year. Guinea’s second largest export market is the UAE, followed by Netherlands (for diamonds), India (for gold), and France. Hence, any leader – established by a coup or democracy – must care about international markets.

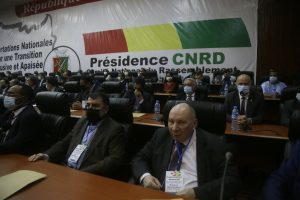

Thus, in a bid to ease international tensions, Mamady Doumbouya lifted an initial curfew in the mining areas and reopened land and sea borders. He also announced consultations with relevant stakeholders to lead the formation of a transitional government. The transitional government will be tasked with laying a framework for national unity and the return of constitutional order, reportedly including scheduled meetings with civil societies, diplomatic missions, business leaders, and the heads of mining companies.

With these actions, so far the shock of the political upheaval has not caused any actual interruption in Guinea’s export of commodities. Reporting by CNBC stated that Rusal (Russian aluminum company) vowed to maintain its bauxite mines despite the political upheaval.

Did investment concerns run deeper in China? China relies on Guinea for more than half of its total bauxite imports needed to produce aluminum. The two top producers of Bauxite in Guinea are (SMB) Societe Miniere de Boke – a subsidiary of the Chinese Hongqiao and Guinea’s UMS International – and Compagnie des Bauxites de Guinee (CBG) of which 51 percent is owned by Halco Mining Inc and 49 percent owned by the Guinean government. Indeed, Guinea is one of just 15 African countries that have a trade surplus with China and the country is China’s ninth largest African supplier overall. So the coup certainly raised eyebrows in Beijing. Already there is an 18-month high in delivery prices to China caused by the coup.

While all the above make Guinea important to China, context is everything. The fact is, Guinea is also just one of 55 African countries whose entire exports to the rest of the world – including to China – account for just 3 percent of global trade value. There are other bauxite producers. If anything, the China-backed investment to bring two blocks of the Simandou range into production by 2025 is likely to be of greater concern for Beijing.

However, this is also to some degree short-term thinking. The longer-term answer lies in whether the coup will really matter to Guinea’s development in the long run. This is where the key conundrum lies. While coups do create initial flurries of concern, there is little evidence of correlation between specific types of governments and long-term development patterns – positive or negative. Over its fairly short history as a nation since independence from France in 1958, Guinea’s commodity dependency has remained the consistent factor.

Thus, while 2021 might be a year of disruption for Guinea’s young democracy, the key challenge remains the journey toward a shift in its underlying economy and relationship with the rest of the world.