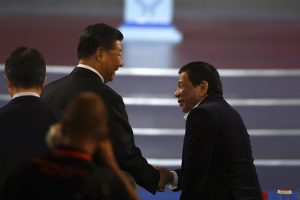

With the end of Philippine President Rodrigo Duterte’s administration in sight, a thorough reassessment of his China policy in the development sphere seems warranted. According to some journalists and analysts, large-scale Chinese projects under Duterte have failed to actualize. For these observers, large Chinese infrastructure projects come in two forms. On the one hand, they may broadly refer to Chinese-funded infrastructure such as dams, bridges, railways, and airports. On the other, they could be pointing to Chinese projects negotiated with, and implemented by, the National Economic and Development Authority (NEDA).

While it is true that Chinese state-funded infrastructure projects have been few and far between under Duterte, we argue that fixating on large-scale Chinese projects obfuscates the different modalities of Chinese capital – including special purpose vehicles (SPVs), foreign direct investment (FDI), and flexible capital – in the Philippines. Since the Duterte administration partnered with China, breaking with the confrontational policy of the Benigno Aquino administration, Chinese policy banks, central state-owned enterprises, and major private firms were encouraged to invest or operate in the Philippines. In addition, Duterte’s coalitional elites invited Chinese billionaires to move their savings into the Philippine online gambling sector. In other words, Duterte’s administration has led to the surge of different types of Chinese capital, which have had enormous political, developmental, and social implications above and beyond large-scale infrastructures.

The first and most obvious form of Chinese financing are overseas development assistance (ODA) projects, which are defined by the OECD Development Assistance Committee as foreign projects funded at concessional rates with longer than normal grace periods. NEDA’s most recent report shows that there were only five ongoing or completed Chinese ODA projects as of 2021. Compared to Japan (45), the Asian Development Bank (52), and the World Bank (29), the number of Chinese projects has been dismal. An interesting tidbit is that the Chinese projects in NEDA’s report do not conform to the standards of the ODA projects. Chinese capital diverges from the ODA definition and takes on different forms, including hidden debt created through SPVs, FDI, or flexible capital in illicit sectors. NEDA understates these forms of Chinese capital, which have had enormous development and social effects on Filipinos.

SPVs are host country entities that receive money from PRC policy banks to maintain the host country’s debt-to-GDP ratio. This is the case of the Dito Telecommunity foreign direct investment (FDI) which is worth at least $5.4 billion with dozens of new grids currently under construction across the country. Chinese policy banks lent money to the Dito consortium, comprising Udenna Corp and Chelsea Logistics, firms owned by Dennis Uy, one of Duterte’s own cronies, and China Telecom, to invest in Dito Telecommunity. While some argue that China Telecom might divest from the Dito due to the second or third year of operating without profit, what they miss is that short-term profit-making is not the goal of major state-owned enterprises like China Telecom. Rather, investing capital in a sector ripe for competition and strategic gains of telecommunications are already major wins for both China Telecom and the Chinese state.

While the Philippine government is not directly indebted to the PRC with regard to this loan, Duterte and his coalition’s support for Uy created an implicit support that the Philippine government will bail out Dito if the investment fails. In other words, it is unlikely that the PRC would have funded Uy to co-invest in Dito if not for Duterte’s positive relations with China and assurance that he will protect Chinese commercial interests. SPVs have been called vectors of “China’s hidden debt” by AidData.

This is also the case of the Chinese Development Bank’s loans to Kereta Cepat, an Indonesian Chinese consortium in charge of constructing the Jakarta-Bandung Railway High-Speed Railway. Joko “Jokowi” Widodo’s administration has been able to protect itself from accusations of the Chinese “debt trap” and dependency on Chinese loans by hiding the Jakarta-Bandung deal through SPVs. While the Jokowi administration’s dept-to-GDP ratio has been kept at a minimum, this deal has enormous implications in terms of making the Chinese firms – the partners in the Jakarta-Bandung deal – long-term stakeholders in Indonesia’s railway sector.

The second thing to note regarding Chinese investment under Duterte is the extent to which FDI is a major vector for state funding. At times, the Chinese state facilitates big FDI projects by hosting high-level meetings and making Chinese funding available to firms. At other times, Chinese firms and their host country firm partners begin by working together before going back to their governments about possible ventures. In either case, state-facilitated FDIs are available to firms to invest in countries to improve China’s diplomatic reach and political capital.

It is logical to construe that Chinese FDI, especially the largest and highest valued projects, acquired direct and indirect state assistance to invest in the Philippines because of Duterte’s positive predisposition toward the PRC. For instance, Ant Financial, a holding company directly managed by the People’s Bank of China, completed a joint venture with Globe Telecom to launch Myth, a $1 billion firm in the Philippines. China Telecom in Dito Telecommunity and Ant Financial in Myth are major ventures tied to some of China’s most central institutions. Both deals, which run into billions, are not counted as ODA or large-scale government-led projects, but nonetheless would not have happened without the approval of China’s top officials.

If FDI is included, it is clear that the Chinese investment under Duterte has been considerable. Between 2016 and 2022, Philippines’ Central Bank data shows that firms from China and Hong Kong invested $1.7 billion in the Philippines, trailing only Japan at $2.8 billion. U.S., Korean, and Taiwanese firms lag behind Chinese FDI, having invested $1.3 billion, $1.1 billion, and $580 million, respectively. Moreover, the Philippine Security Exchange Commission’s company registration database, a far more robust dataset than the Central Bank, shows that Chinese citizens have invested ahead of all other nationalities by far. From 2016 to 2018, there were 3,634 firms established with Chinese investors, which was far higher than the number of new firms with Japanese and US investors (1,091 and 1,317, respectively).

Many of these were in the wholesale and retail sector, construction, transportation and services, including hotels and tourism, financial and lending services, and language and translation, among others. Since these are joint ventures, Chinese investors either used Filipino business “fronts” to represent them to the Philippine government, or they legitimately worked with Filipino businesses. In either case, the inflows of major or smaller Chinese FDI increased capital infusion in the country, contributing to growth and employment. There are also negative implications such as distributional issues or a crowding out effect. In either case, there has indeed been a surge of Chinese FDI under Duterte, something that has clearly been linked to the attenuation of the conflict in the South China Sea.

Third, there has recently been a global increase of what scholars have called “flexible capital.” The rise of China as a global power has been accompanied by the simultaneous surge in the number of Chinese billionaires. In recent years, the sources of capital accumulation – export manufacturing, heavy industries, and infrastructure construction – have been limited by overcapacity due to the slowdown of the Chinese economy and the depreciation of the renminbi. Many of these capital holders have responded by extricating their savings from China and moving them into the Global South. Flexible capital moves into illicit sectors over which host countries have little regulatory control. In Cambodia, Laos, and Myanmar flexible capital can be found in plantations owned by private Chinese investors. In sub-Saharan Africa, artisanal and small- scale mining operations that hire child labor for the mines and local rebel groups to protect their properties have been reported.

In the Philippines, flexible capital can be found most notably in online gambling. Approximately 129 online gambling firms began their operations by legally or illegally importing hundreds of thousands of Chinese-speaking workers. Online gambling firms have purchased a huge stock of condominium units in Metro Manila, leading to the increase in real estate prices beyond the range that most Filipinos can afford. Manila’s land prices rose an average of 6 percent in 2017, with the Manila Bay Area seeing the biggest increase at 27 percent. Alongside online gambling, on-site casinos with escort services have expanded in Metro Manila, booked through WeChat, the Chinese chat client, to cater to Chinese, East Asian, Filipino, and Western customers. Unregistered online gambling firms, which frequently conduct internet fraud, have also proliferated across the capital. Despite online gambling’s divestment due to COVID-19 in 2020, online gambling has become a mainstay economic sector in the Philippines.

In sum, focusing on large-scale NEDA infrastructure projects alone and asserting that Duterte did not gain anything from China are simply untrue and could miss understanding significant processes at work. Analysts might instead look at projects that fall outside of the formal ODA category, including huge FDI ventures worth billions or smaller ventures in legitimate industries, as well as the creation of hundreds of new firms in illicit sectors. Duterte’s failure was not that he could not bring Chinese money to the country, but rather could not make Chinese projects more developmentally inclusive to Filipinos. This trend, alongside the abuses of the Chinese Coast Guard in the South China Sea, generates continuing negative sentiments toward the PRC.