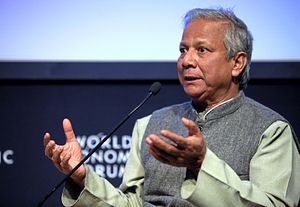

The Grameen Bank was founded as a private bank in Bangladesh in 1983, with the authorization of the Bangladesh national government. Mohammad Yunus, its founder, eventually won a Nobel Peace Prize in 2006 for the profoundly positive disruptive effect of the micro-credit work that bank was doing in Bangladesh. Conceptually, what the Grameen Bank did for the poor in Bangladesh, particularly the 96 percent of its debtors who are women, was unprecedented. Micro-credit fundamentally empowers the poor, who would otherwise lack access to financing. Contrary to conventional loans, micro-credit loans are more tolerant of counterparty risk and employ a group-based approach to ensure loan repayment and financial discipline. The conceptual approach to tackling poverty — that loans are preferable to charity — has spread beyond the Grameen Bank to other similar microfinance institutions across the world.

The Grameen Bank as an institution has always been partially intertwined with the Bangladesh government. Its sources of funding have oscillated between private donors and the government. In the 1990s, the bank began receiving a fundamental portion of its funds from the central bank of Bangladesh. Recently, the bank has also received implicit government subsidies as it has sought financing through bond sales. The government and the Grameen Bank have since been engaged in something of a tug-of-war over the bank’s independence. In 2011, Mohammad Yunus was forced to resign from leading the bank — the government cited his age as a factor. The government argued that Yunus’ appointment as the managing director of the Grameen Bank should have been vetted by the Central Bank, but since it wasn’t, it was in violation of the laws governing Grameen’s operations in Bangladesh.

Despite Yunus’ popularity abroad, he has faced vocal critics in Bangladesh who claim that the Grameen Bank’s work has been improperly regulated and that the bank has been negligent in its obligations to the government. This political undercurrent certainly motivated Yunus’ ouster as well. More recently, as Bangladesh’s The Daily Star reports, the government has continued its assault on Grameen’s independence by transferring the power to appoint members of the Grameen Bank’s board to the central bank. Akbar Ali Khan, a former Grameen Bank chairman, notes that “If the new rule is acceptable to [both experts and elected members of Grameen Bank], there will be no politicization of the bank. But if they don’t accept the new rule, it will create distortion. If the bank is politicized, it will be destroyed,” he said. The move has been met with significant criticism from several prominent intellectuals in Bangladeshi society.

Ostensibly, critics of the government’s actions toward the bank believe that it is precisely relative regulatory independence that allowed Grameen to successfully navigate its mandate to serve Bangladesh’s poorest. It did so with the help of government in the past, but it appears that the government of Bangladesh is now overstepping the line into over-regulation. Micro-credit loans, in themselves, have been somewhat controversial, but a recent 20-year longitudinal World Bank study entitled “Dynamic effects of microcredit in Bangladesh” authoritatively points in the direction of micro-credit being immensely effective at reducing poverty by increasing household spending, labor supply, and women’s labor force participation rate. Criticism of microfinance mostly points to elements of human greed emerging on the supply side, with lenders employing strong-arm collection tactics against delinquent debtors and charging usurious interest rates in certain cases.

Following in Grameen’s footsteps, Bangladesh now is home to at least 500 micro-credit loan providers. Should Grameen begin to suffer inefficiencies at the hands of the government, other providers will attempt to step in to operate with greater independence. According to the World Bank study cited above, almost a third of all micro-credit debtors have multiple loans from more than one micro-credit provider. Government regulation could have a chilling effect on microfinance-led efforts to reduce poverty in Bangladesh. Grameen’s eventual absorption by the central bank could lead to fears among other microfinance providers that the government will come for them should they grow large enough. Bangladesh’s government and central bank should tread carefully as they attempt to wrest control of one of the more effective poverty-alleviating institutions in their country.