The Santa Cruz Hydroelectric Project in Argentina is a key cooperation project between China and Argentina. The $4.7 billion dam project is being carried out by a consortium led by China’s state-owned Gezhouba. However, the financing agreement is currently suspended, and with it the construction of the dams.

As a result, one of the projects that was once the flagship of the union between the government of Cristina Fernández de Kirchner and the administration of Xi Jinping is now a sign of the cooling of those relations.

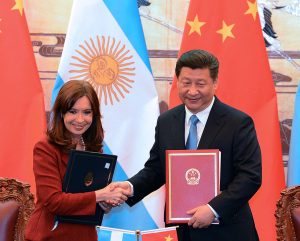

The joint venture composed of Gezhouba and Argentine firms EISA (a member of the Electroingeniería Group) and HIDROCUYO won the bid for the project in October 2013. A consortium of financiers comprising China Development Bank, ICBC, and Bank of China entered into a project finance agreement with the government of Argentina, with President Xi Jinping and then-President Cristina Fernández de Kirchner as witnesses at the Casa Rosada in July 2014.

The list of bidders also included another Chinese state-owned firm, Sinohydro of the PowerChina Group, as well as Brazil’s Odebrecht and OAS, France’s Alstom, South Korea’s Hyundai Engineering and Construction, and Spain’s Isolux Corsán, which is no longer in operation.

The project site is 145 kilometers from the tourist center of El Calafate, from where the Lago Argentino and the Perito Moreno Glacier can be accessed. Two hydroelectric dams are planned on the Santa Cruz River, in the province of the same name.

Diagram of the two dams on the Santa Cruz River Image from the Ministry of Energy – Argentine Republic.

According to information provided by the consortium, the Santa Cruz Hydroelectric Project directly employs 2,025 people. Once the maximum work capacity is reached, it is expected to employ 6,000 people directly and another 10,000 indirectly.

Agustín Gerez, president of the Argentinian state-owned company Integración Energética Argentina (Ieasa), indicated that “the Néstor Kirchner dam is close to 20 percent advanced and the Governor Jorge Cepernic dam is at 25 percent, estimating to have the first turbine in operation in 2023.”

These estimates, as reported by the state news agency Télam, are optimistic visions, which are not exactly shared by the Chinese side, as Reporte Asia was able to confirm.

Originally, the loan was signed in 2014 for a $4.7 billion credit line with a Libor + 3.8 percent interest rate. The creditors are China Development Bank (providing just under $2.5 billion), Industrial and Commercial Bank of China (just over $1.4 million), and Bank of China ($801 million).

So far, the consortium of financiers has granted loans for $1.35 billion, 29 percent of the contract value. Due to the reduction of the power generation capacity and the scope of work, the suspension clause of the financing contract was automatically activated. The last loan was issued in November 2017. Over the past three and a half years, Gezhouba has provided $350 million to UTE as working capital through its Beijing corporate credit facility. Given the current working capital difficulties, it is urgent to accelerate the negotiation and reactivate the suspended financing agreement.

Gezhouba, as the leader of the joint venture, coordinates the negotiations between the Chinese banks and Argentina’s Strategic Financing Department. The resumption of the financing agreement – which requires the signature of the Argentine government – was expected by the end of 2021, but there have been no concrete signs yet that officials are moving forward.

Various interruptions and delays have put the Argentine government in the situation of having to start repaying the part of the loan already obtained, while the dams are still incomplete. There are some drawbacks that add to the economic difficulties Argentina is going through. On the one hand, the debt cannot be restructured. On the other hand, there are cross default clauses that may affect other projects of Chinese state-owned companies such as the Belgrano Cargas Railway.

This piece was originally published in Spanish by ReporteAsia.