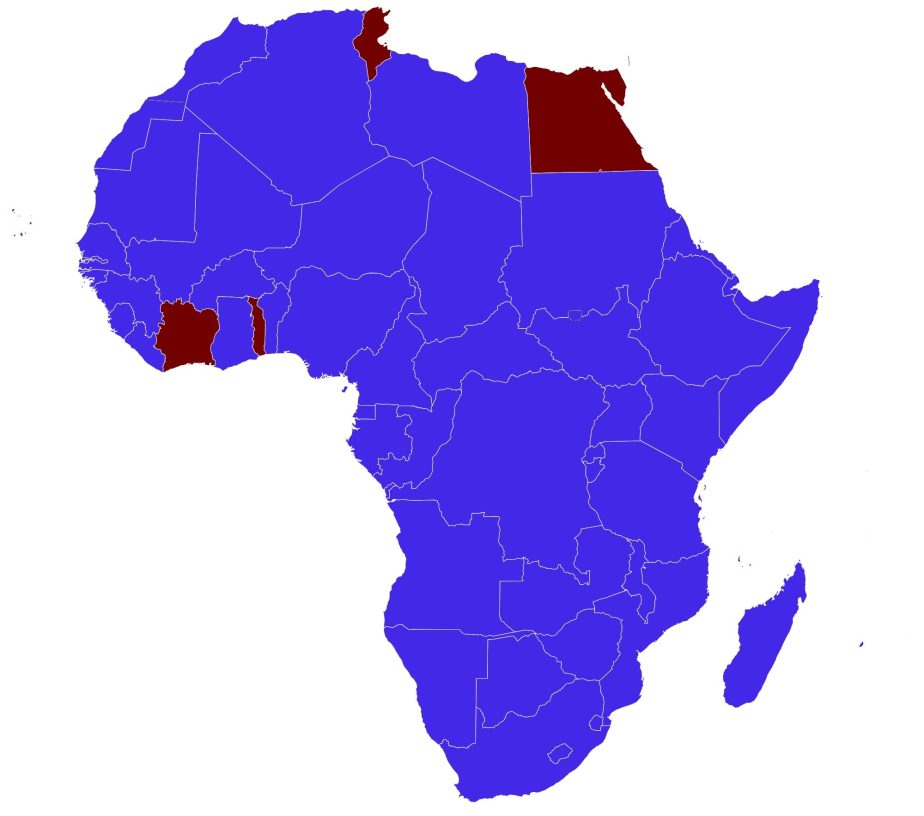

In keeping with a tradition spanning over three decades, China’s foreign minister is set to embark on his first annual overseas trip to the African continent, reinforcing diplomatic ties. Between January 13 and 18, Wang Yi will visit four African nations: Egypt, Tunisia, Togo, and Cote d’Ivoire. For Wang, a veteran diplomat, it’s his 11th first annual visit to Africa as part of the established tradition; he’s made the trip every year since 2013 (except for 2023, when Qin Gang was briefly in the foreign minister post).

Wang’s four destinations – Egypt (included in the Chinese foreign minister’s first annual trip for the second consecutive year), along with the three francophone countries of Tunisia, Togo, and Cote d’Ivoire – reflect China’s continuing interest in North Africa and West Africa.

This year holds particular significance in Africa-China cooperation as the Ninth Ministerial Conference of the Forum on China-Africa Cooperation (FOCAC) will be held in Beijing, the first during President Xi Jinping’s third term. Wang’s agenda for this trip will no doubt include reviews of the implementation of the outcomes of the 8th FOCAC and coordination for the coming FOCAC.

Despite engagement through plurilateral mechanisms like FOCAC and the Belt and Road Initiative (BRI), bilateral meetings between top leadership remain the primary channels for African nations to articulate their national priorities and for China to deliver on FOCAC and BRI commitments. And most African countries have significant and unique bilateral agendas to discuss with China. Hence, between 2009 and 2023, our in-house data suggests that Chinese leaders undertook 102 visits to the continent, reciprocated by 237 visits from African leaders to China.

So what might be the key items on the agenda for each of the four countries in Wang’s itinerary, especially from the African countries’ perspectives? What might Wang’s hosts be looking to get out of the visits?

Egypt

Egypt has been the top African destination for Chinese leaders’ visits since 2016, with a tally of five visits, underscoring the country’s strategic importance to China. Egypt’s Suez Canal is a key transit point for China’s BRI, as evidenced by the over $8 billion Chinese companies have committed to the Suez Canal Economic Zone.

As the first full African member of the Asian Infrastructure Investment Bank (AIIB) since 2016, and now officially a member of the BRICS, Egypt’s engagement with China through various mechanisms demonstrates their multifaceted partnership.

Beyond the economic realm, Egypt also has an instrumental role in security issues within the Middle East, a facet that is of growing interest to China. Security is high on China’s diplomacy agenda, aligning with its active promotion of the Global Security Initiative (GSI) proposed by President Xi Jinping in 2022. While the Israel-Palestine conflict continues and tensions in the Red Sea grow, Egypt has been playing a pivotal role in mediating conflicts and brokering ceasefire deals.

In October 2023, Xi Jinping commended Egypt’s constructive role in the region and expressed willingness to strengthen cooperation in reaching a ceasefire. Undoubtedly, regional security issues will be a major discussion topic during Wang’s visit to Egypt.

However, for Egypt, economic cooperation will be the primary focus. China is Egypt’s largest trading partner, albeit with a notable trade deficit of $9.6 billion in 2022. Moreover, Egypt hosts $1.2 billion of Chinese foreign direct investment (FDI) stock.

Amid challenging economic conditions marked by high inflation, currency devaluation, and heavy foreign debt servicing, Egypt sees China as a key financing source. In October 2023, Egypt issued Africa’s first Sustainable Panda Bond worth 3.5 billion Chinese yuan ($478.7 million) to tap into the Chinese capital market; and in the same month, the Central Bank of Egypt secured a 7 billion yuan loan from the China Development Bank.

As Wang engages with Egyptian leaders, the two countries will be aiming to deepen mutual benefits from their dynamic partnership.

Tunisia

On January 10, 2024, China and Tunisia celebrated their 60th anniversary of diplomatic ties with a joint commitment to strengthen bilateral relations. The most recent high-level encounter between the two nations occurred at the first China-Arab States Summit in December 2022, where the leaders of Tunisia and China convened and committed to advancing collaboration in medicine and healthcare, infrastructure, and the high-tech sector, and fostering expanded exchanges in human resources.

Economic collaboration stands as a crucial pillar in the China-Tunisia partnership, particularly in light of Tunisia’s substantial external debt, which hovered around 90 percent of its GDP in 2022. In April 2023, the country rejected a $1.9 billion IMF loan due to the loan’s stringent conditions.

Although the last time Tunisia borrowed from China was in 2009, Tunisia may well now be looking to China to secure alternative financing sources to avoid default, as well as to continue investment in development, especially infrastructure. Over recent years, Chinese aid to Tunisia has mainly focused on construction and health, including for the Tunisian Diplomatic Academy, Sfax Hospital, Ben Arous Youth Sports and Cultural Center, and vaccines and medical supplies during the pandemic.

Furthermore, tourism too, constituting 5 percent of Tunisia’s GDP and a vital source of local employment, is likely to feature prominently in the agenda. As part of efforts to boost tourism from China, Tunisia waived visa requirements for Chinese tourists in October 2023, with plans to establish a direct airlink between Tunisia and China in 2024. The question Tunisia’s leaders may want to raise is how the Chinese government can facilitate meaningful tourist inflows.

Togo

Togo – a francophone West African country that uses the CFA franc and houses the headquarters of the West African Development Bank (BOAD) – has had decades of productive relations with China. Both governments so far consider each other pragmatic partners that prioritize core interests and top-level concerns. The 50th anniversary of diplomatic relations celebrations in 2022 solidified this robust bilateral relationship.

Since 2010, Togolese leaders have undertaken four visits to China, reciprocated by a singular visit from China to Togo.

During Wang’s trip, Togo will seek to reinforce economic ties, especially before Togo’s upcoming election in the first quarter of 2024. Trade figures, reaching $2.3 billion in January-July 2023, a 14 percent increase from the same period in 2022, demonstrate the flourishing economic ties, prompting Beijing to safeguard and enhance existing cooperation programs.

According to AidData, the last time Togo received a loan from China was in May 2016, when the Export-Import Bank of China and Ministry of Economy and Finance of Togo signed a $67 million loan agreement to finance Phase 2 of the modernization and expansion of the Gnassingbé Eyadéma International Airport (a project completed in 2019).

Togo’s ambition to double the mining sector’s contribution to GDP by 2025 also offers Chinese companies an opportunity to participate in resource development and value-addition, exemplified by Togo’s creation of a state-owned manganese company in April 2023.

From China’s perspective, maintaining favorable relations with Togo and BOAD, the West African Development Bank, is a priority, particularly for regional development and security. Furthermore, Togo’s reputation as a mediator in regional negotiations on peace and security may well align with China’s focus on bolstering the GSI. Given China’s past cancellation of Togo’s debts and the removal of custom duties on Togolese imports, both nations seek to sustain these positive trends.

Cote d’Ivoire

Cote d’Ivoire, home to the headquarters of Africa’s most prominent financial institution, the African Development Bank (AfDB), also has a strong bilateral relationship with China. Cote d’Ivoire’s exports to China have grown at an average rate of 18.2 percent over the past 26 years, from $7.4 million in 1995 to $574 million in 2021, mainly focused on primary products – rubber, oil and manganese. Along with rising imports, this had made China Cote d’Ivoire’s largest trading partner, accounting for just under 15 percent of overall trade. Chinese investments in Cote d’Ivoire stand at $7.5 billion as of 2023, concentrated in infrastructure and expanding into various sectors.

In addition to this, there has been some collaboration in agriculture, with Chinese experts aiding Ivorian farmers in rice farming techniques. The Guiguidou hydro-agricultural area serves as a demonstration of successful cooperation in various agricultural projects. Furthermore, cooperation agreements in 2022 materialized into operational rubber processing plants in 2023, with an annual capacity of approximately 260,000 tons, equivalent to a quarter of the country’s rubber production.

Another resource Cote d’Ivoire is looking to leverage is its logistics. The Port of Abidjan was expanded through Chinese-funded cooperation and new ports were opened in 2022, a boon for both countries and bilateral ties. A cooperation deal signed with China’s Guangzhou Port Authority will mean that large vessels don’t need to stop in South Africa before smaller vessels can then move to Western Africa. This is a serious and mutually beneficial development vis-à-vis strengthening the BRI.

Cote d’Ivoire’s infrastructure investment push has also led it to secure a $200 million loan for rural roads projects from the AIIB, justified for its potential to increase trade with Asia, which was approved in July last year.

Last but not least, with a growing partnership in security, highlighted by a contract with China North Industries Corporation for military assets, Cote d’Ivoire also positions itself as a valuable ally in counterterrorism operations.

The upshot? Although the selection criteria for this year’s four countries for the visit remains unclear, all have significant potential demands from their relationships with China in their development interest.

In turn, for China, amidst global uncertainties, Wang Yi’s diplomatic voyage to Africa signifies not only a continuation of a longstanding tradition but also an interesting effort to navigate the complex intersections of diplomacy, economics, and security, in a new year that is only certain to be full of both change and drama.