Large and small companies in the United States and elsewhere have seen their supply chains significantly affected and disrupted by the ongoing COVID-19 pandemic. Just as China’s economic situation began to improve with its handling of the pandemic, the virus — and accompanying economic disruption — spread to the rest of the world.

One of the immediate effects on companies using overseas manufacturing has been serious supply chain disruption. As the pandemic continues, many companies are rethinking supply chain risks.

To better understand how the COVID-19 pandemic might affect thinking on supply chain risks in the United States and elsewhere, The Diplomat’s senior editor, Ankit Panda, spoke to Hitendra Chaturvedi, a professor at the Supply Chain Department of W.P. Carey School of Business at Arizona State University and an expert on global supply chain sustainability and strategy.

The Diplomat: COVID-19 was initially seen as a supply shock given the effects it was having on China by early February. How has this changed over the last three months?

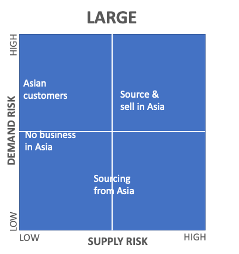

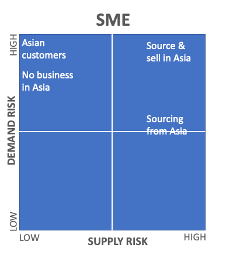

Hitendra Chaturvedi: The impact of COVID-19 should be looked at in two dimensions – supply and demand. Moreover, it should be looked at from the perspective of SME (small and medium enterprises) and large companies. If you look at supply and demand impact on large and small-and-medium enterprises (SMEs) you will realize that the impact has been very different for companies in various positions of the quadrant.

SMEs have been obliterated, no matter if the supply risk was from China or not, because the demand just fell off the cliff and they did not have enough cash to weather the storm.

Initially some tried to source locally (near-source), but the prices were too high and they could not sell and therefore were stuck with unsellable inventory or sold at previous prices that impacted their margins. While they were trying to find stock anywhere to sustain operations, the demand fell off the cliff and they were stuck with no demand and cash locked in a high-priced inventory.

Large businesses fared a bit better as they had more of a cushion to ride this wave.

In some cases, they even used this event to see their smaller competitors go out of business to consolidate their customer base.

Do you anticipate that firms might move away from just-in-time (JIT) manufacturing practices that showed their vulnerabilities during this pandemic?

In the short term the firm will have a knee-jerk reaction and try to keep inventory close to home, close to customers, and in manufacturing operations, but I predict that as competition increases—and since we have short memories, and since profits trumps most things—we will go back to the JIT model again, but with a small change that manufacturing will move a little closer to home.

In North America, I foresee Mexico and Latin America playing a bigger role and potentially replacing China for North America and Europe. There are many advantages to Mexico, for instance, which include:

- Already manufacturing done there – tested and tried

- Lower cost than China

- Faster delivery, so lower in-transit inventory, so lower costs

- A rising middle class wanting better life

- A hardworking work force

- Easy access to ports

- Close proximity to the United States

- Culturally similar

- Strategically aligned

- Quick reaction to any unforeseen event like a pandemic

- Possible to lock down U.S./Canada/Mexico together to address future pandemics

In my opinion the move will be less away from JIT, and more away from manufacturing in faraway places to find closer manufacturing locations.

To what extent might high value-add businesses around the world work to make themselves more resistant to supply chain shocks arising from pandemics, natural disasters, and other such events?

I will focus my answer on large businesses as SMEs do not have the financial muscle to create a mitigation strategy against pandemics.

Just like data centers in the ’90s had very clear disaster recovery plans, we will start to see large businesses build a pandemic recovery plan. Most large companies will be doing pandemic drills just like we have fire drills in school.

Large companies will actually start to build AI-enabled pandemic scenarios (just like we build weather scenarios today) to predict pandemics (just like we predict hurricanes) and have a disaster recovery plan based on that.

We will also start to see inventory “stashes” across global locations that will act as insurance. This will add cost and which will be passed on to consumers so we may see a price increase in our products. Data shows that close to 40 percent of companies that had a plan to mitigate China tariffs fared better during the pandemic.

Finally, reliance on technology will be crucial. AI-driven chatbots will bring call centers home, IoT driven AI will make robotic process automation smarter and bring more manufacturing closer to home (bots don’t get COVID-19), 5G will enable more work from home, online security companies will have a field day, and finally, most education and training will be done online.

This interview has been edited and condensed.