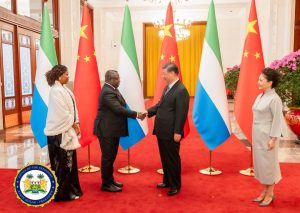

From February 27 to March 2, Sierra Leone’s President Julius Maada Bio paid a state visit to China at the invitation of Chinese President Xi Jinping. It was the first visit to China by an African president in 2024.

Our past research shows that frequent, high-level visits to China by African leaders are often correlated with stronger trade and investment relationships with China. But how exactly does this happen? And will this correlation continue, especially with concerns being expressed internationally about the state of the Chinese economy?

A closer look at Bio’s visit last week provides some vital clues.

Sierra Leone and China established diplomatic relations on July 29, 1971. Between 2009 and 2024, Sierra Leone’s presidents made six visits to China, above average compared to other African countries. Furthermore, a mere 10 months ago, Sierra Leone’s foreign minister, David J. Francis, visited Beijing. The frequency of Sierra Leone’s high-level visits clearly demonstrates that China is a priority partner for the country. There are several reasons for this.

First, China is by far Sierra Leone’s biggest export destination. In 2021, Sierra Leone exported $341 million worth of goods to China. Sierra Leone’s second-largest export destination was Belgium, which amounted to less than half the value ($161 million). This makes Sierra Leone one of the few African countries with a trade surplus with China. According to China’s General Administration of Customs (GAC), in 2023 Sierra Leone earned $1.65 in exports for every $1 it imported from China. That said, Sierra Leone exports primarily raw materials to China, such as titanium, iron and aluminum ores, followed by wood and diamonds, which leads to the second reason why China is important for the country.

China is also Sierra Leone’s biggest source of foreign direct investment (FDI). For instance, in 2021, China invested $106 million in the country, compared to the United Kingdom’s $66 million and the United States’ $1 million. However, like other investors, to date, Chinese investment in Sierra Leone has focused heavily on the mining of various minerals and iron ore processing.

Third, China’s lending for infrastructure development as well as aid for other sectors such as livelihoods, healthcare, education, and agriculture has been a key area for collaboration from Sierra Leone’s point of view. For example, the China-Sierra Leone Friendship Highway remains Sierra Leone’s sole modern expressway, playing a pivotal role in connecting the capital city of Freetown with other major urban centers.

This third priority, however, has not come without challenges. For instance, in 2018 a new airport project was canceled by the incoming government (still incumbent today), in particular due to concerns raised by the IMF and World Bank about Sierra Leone’s debt sustainability levels. However, new projects utilizing Chinese financing and firms have since been announced, such as a new bridge to the existing airport – the MOU for which was just signed in late 2023 – which is expected to be completed by 2027.

And last but not least, Sierra Leone has been the chair of the African Union’s Committee of Ten (C10) on reform of the United Nations Security Council (UNSC) ever since its creation in 2005. Since China is one of the five permanent members of the UNSC, Sierra Leone is mandated to consult with China regularly on behalf of the African continent to strengthen China’s support for the African Union’s position on reform of the UNSC.

What about China’s interest in Sierra Leone? Just over seven years ago, in December 2016, China and Sierra Leone established a comprehensive strategic cooperative partnership (CSCP). A CSCP is considered the highest level of bilateral relations for China, a position that only 14 African countries hold with China (the others are the Republic of Congo, Democratic Republic of Congo, Ethiopia, Gabon, Guinea, Mozambique, Kenya, Namibia, Senegal, South Africa, Tanzania, Zambia and Zimbabwe). There must be something special about Sierra Leone – a country with the population size similar to that of the Chinese city of Chongqing – from China’s point of view as well.

First, Sierra Leone might be a small country but it does have significant mineral resources. China has been making steps to diversify its sources of key mineral and energy imports to enhance resilience and energy security. For example, Sierra Leone made two high-level visits to China in 2019 and 2023. During this period, Beijing was working to reduce reliance on Australia’s iron ore exports, which is Sierra Leone’s key export to China. The 2019 visit resulted in a joint economic and technical cooperation agreement, followed by a noticeable increase in Sierra Leone’s exports to China, from $179 million in 2019 to $762 million in 2022.

Second, if influencing China on African positions on global governance is important to Sierra Leone, the interest also runs the other way. Sierra Leone’s leadership within the AU on UNSC reform makes it crucial to engage with to explain Chinese positions and views as well as understand African perspectives.

These mutual historic interests aside, the key question remains as to what the future holds for the bilateral relationship, and what this also means for other African countries.

The main difference this time was Bio’s heavy focus on diversifying investment.

The Bio administration has been working toward positioning Sierra Leone as a key global investment destination, with an emphasis on Sierra Leone’s safety and political stability. Key reforms have been launched to improve Sierra Leone’s business environment, including fast-track procedures for business registration and “one-stop services” for potential investors at the National Investment Board.

At part of these efforts, Bio presided over an investment forum during his visit to China, which we attended. Sierra Leonean ministers made detailed presentations on bankable projects to Chinese attendees from diverse sectors including infrastructure, mining, ICT, manufacturing, and education.

Importantly, the presentations called for not only investments in infrastructure and mining, but also in agriculture and agro-processing of palm oil, rice, sugar, cocoa, oil palm, poultry and seafood, all with a view to providing new jobs in Sierra Leone as well as cutting poverty. Accordingly, the forum also called for investments in education, training, and skill transfers.

That said, and as we listened to these presentations, a key gap that stood out was the lack of demand for innovation from the African side. For example, there was no explicit push from Sierra Leone to climb up value chains of its existing exports to China and further develop its manufacturing capacity in those products. And while Sierra Leone has duty-free access to developed markets in North America and Europe as well as China, there was little focus on investment in agro-processing for exports to China – including of products that might require sanitary and phytosanitary (SPS) agreements, of which Sierra Leone currently has none with China.

Nevertheless, Bio’s visit suggests that China’s appetite for holistic engagement with Africa – from infrastructure to trade and investment as well as international relations – remains strong, with no significant barrier posed by China’s domestic economic challenges. It also indicates that many African countries, including Sierra Leone, are actively trying to diversify their engagement with China. Will both sides succeed?

With the ninth Forum on China-Africa Cooperation (FOCAC) fast approaching in late 2024, and with African countries working hard to recover from COVID-19 and other global shocks, African leaders will need not only to maintain and diversify engagement, but also push Chinese stakeholders to try new approaches.