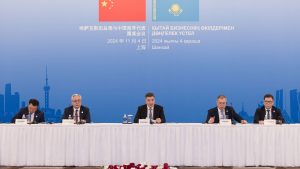

During a working visit to Shanghai this week, Kazakhstan’s Prime Minister Olzhas Bektenov attended a Kazakh-Chinese investment roundtable, met with Chinese Premier Li Qiang, and participated in the 7th China International Import Expo.

Bektenov’s trip sought to implement ambitions stated by Kazakh President Kassym-Jomart Tokayev and Chinese leader Xi Jinping during their meeting in Astana in July to double the volume of bilateral trade.

In 2023, the trade volume between the two countries reached $41 billion. Although China is now billed as Kazakhstan’s top trade partner, for comparison, the EU did about $42.4 billon euros (about $46.2 billion) in trade in goods with Kazakhstan in 2023.

Moreover, China-Kazakhstan trade is tilted in China’s favor, with $24.7 billion in exports to Kazakhstan in 2023 and $16.4 billion in imports from Kazakhstan; Kazakhstan’s trade with the EU is tilted the other way, with the EU importing around 30.3 billion euros ($33 billion) – mostly oil and gas – while exporting just 12.1 billion euros ($13.2 billion) to Kazakhstan.

“The Government of Kazakhstan is ready to expand partnerships and build strong bridges between our nations,” Bektenov said at the investment roundtable, highlighting Kazakhstan’s ambitions for greater economic cooperation with China. “We will provide support to investors, creating favorable conditions for business and contributing to the success of each project.”

Bektenov oversaw the signing of eight commercial agreements between Kazkah and Chinese companies worth $2.5 billion. Five of the agreements involved a company named Qarmet JSC. Although the deals were branded as commercial, there’s considerable state involvement given that Qarmet JSC is owned by a state-owned private equity fund, the Qazaqstan Investment Corporation (QIC).

Until recently, Qarmet JSC was known as ArcelorMittal Temiritau. The integrated steel and mining company – which runs, among other things, Kazakhstan’s largest steel plant – was the center of considerable tragedy and controversy over the years due to a series of unfortunate accidents as the company’s mines and plants.

In late October 2023, 46 people were killed in a fire at the Kostenco coal mine, operated by ArcelorMittal Temirtau. ArcelorMittal Temirtau had been a subsidiary of the Luxembourg-based multinational steel corporation ArcelorMittal since 2006. Shortly after the fire, ArcelorMittal confirmed it was in talks with the Kazakh government to transfer ownership, and in December 2023 the deal was done. According to media reports, around the same time Andrei Lavrentyev — chairman of the board of directors and shareholder in Kazakh automaker Allur — was said to be the company’s “new investor,” paying $286 million for the enterprise and a pipe plant in Aktau as well as taking on commitments to repaying $700 million in loans to ArcelorMittal and investing $3 billion in the newly acquired company. Within a week, the company’s new owners changed its name to Qarmet.*

And now Qarmet has settled a raft of new deals with Chinese partners. These include an agreement with Zhengzhou Coal Mining Machinery Group for $70 million regarding the production of coal industry equipment; a $161 million agreement with Xinxing Ductile Iron Pipes Co. to build a cast-iron pipe plant; a $1 billion deal with China Metallurgical Group Corporation “to establish long-term and comprehensive cooperation in the mining and metallurgical industries” ; a $649 million agreement with ACRE Coking & Refractory Engineering Consulting Corporation to implement a coke-chemical production modernization project; and a $30 million deal with Nanjing Fiberglass Research & Design on the construction of a factory that will produce mineral insulation from blast furnace slag in Temirtau.

The deals with Qarmet make up the bulk of what was reportedly agreed to, and they notably mostly involve the coal and steel industries.

*This paragraph has been updated to clarify Qarmet’s ownership.