Last week, China’s Foreign Minister Wang Yi completed the top Chinese leadership’s 140th trip to African countries since 2007. He did this by continuing a tradition that has been in place for 35 years so far of making the first overseas trip of the new year – or the last overseas trip of the lunar year – to a set of four to five African countries. The tradition is confirmation of Beijing’s longstanding diplomatic ties with the continent.

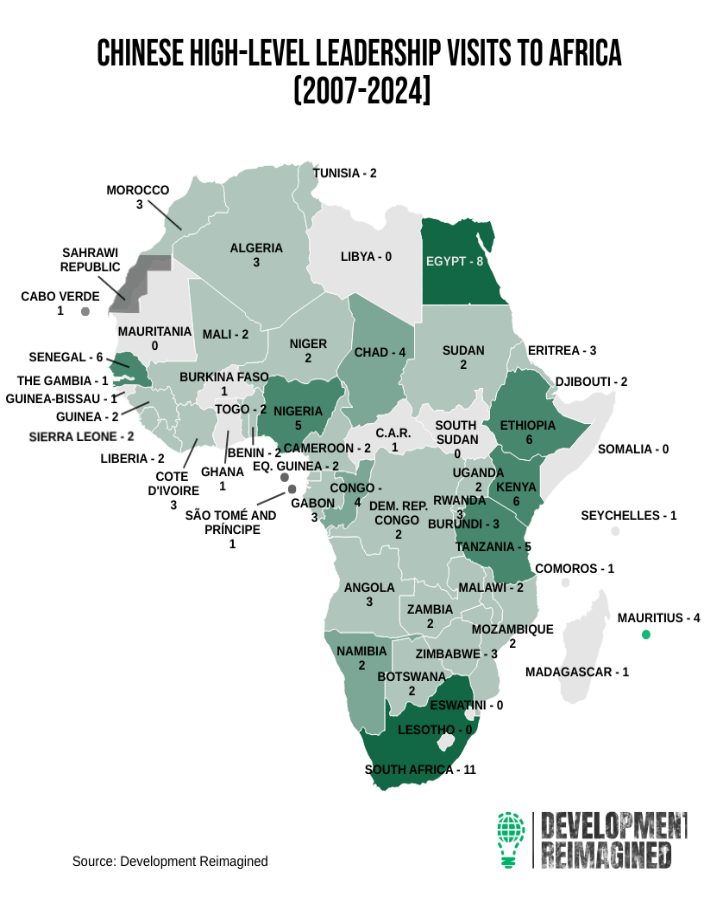

From January 5 to 11, Wang visited Namibia, the Republic of Congo, Chad, and Nigeria. As is the usual practice, Wang’s January tour took him to four African countries varying hugely in land size, geographical location within the continent, demographics, and economic factors and prowess. Unlike many other G-20 countries, China tends not to have designated priority countries or special “friends” on the African continent. Hence, those 140 visits by top Chinese leaders are not highly concentrated – according to databases held by our firm Development Reimagined, only four African countries with diplomatic relations with China (Lesotho, Libya, South Sudan, and Somalia) have not received a visit from either the Chinese president, premier, vice president, or foreign minister since 2007.

The four African countries that Wang visited last week are also countries that China has varied foreign relations with. For instance, the Republic of Congo and Namibia have had comprehensive strategic cooperative partnerships with China since 2016 and 2018, respectively. On the other hand, at the September 2024 Forum on China Africa Cooperation (FOCAC), China upgraded its diplomatic relations with Chad to the strategic partnership level (having only established diplomatic relations in 2006), and with Nigeria to the comprehensive strategic partnership level. Crucially, at the last FOCAC, the Republic of Congo succeeded Senegal to become the next co-chair of FOCAC, and will host its 10th session in Brazzaville in late 2027 before handing over to co-chair position to Equatorial Guinea.

While there has been some coverage of the questions of why these four countries are important to China and what China might want from the visits, an equally important set of questions are why China is important to Namibia, the Republic of Congo, Chad, and Nigeria, what they hope to secure from exchanges with Chinese leaders, and whether this was achieved.

While bilateral foreign minister visits to African countries are not usually expected to result in “deals,” since China is well known for its economic diplomacy, African countries tend to prepare for such visits comprehensively with economic objectives in mind, not just international relations objectives.

While these questions are interesting to analyze country by country, on closer inspection there were some similar approaches and outcomes that can be detected. The outcomes of Wang’s visits set the tone for three key related African aspirations for relations with China in 2025, building on FOCAC outcomes: infrastructure for energy and transport; industrialization (or value-addition); and trade. Each of the four countries of course weighted these areas differently, based on their own conditions and economic ambitions, but the underlying unity was there.

With regard to infrastructure, for instance, energy was a major priority for Namibia – especially given recent power shortages in the Southern African Power Pool (SAPP) – and Congo. Namibia’s National Renewable Energy Policy has identified its vast solar and wind potential as key solutions. Collaborations with Chinese renewable energy firms could advance solar farms, wind parks, and nuclear power projects, positioning it as a green energy leader within the region. However, Congo was more interested in discussing concrete energy projects. In 2022, China Power signed a contract for Congo’s first solar power project with waste-to-energy facilities, and in 2024 Congo entered an MoU with China Overseas to develop the approximately $9.4 billion Sounda hydroelectric dam – the biggest renewable energy project in Congo’s history. The government was keen to push for both of these to progress quickly.

Also in the field of energy infrastructure, although not renewable-energy related, the China-backed 1930-kilometer pipeline running from Niger’s Agadem oil field to the port of Cotonou in Benin – designed to help Niger become an oil-exporting nation and increase its oil production fivefold – was severely disrupted by the July 2023 coup in Niger. There have been recent discussions around rerouting the pipeline through Chad and Cameroon, but there is some pessimism about the viability of this alternative, including due to security risks. The visit offered a chance for Chad to share its views on the rerouting, and encourage China to reinvest.

Congo was also keen to secure support for transport infrastructure based on ambitious plans to transform Pointe-Noire Port into a maritime hub for Central Africa, and the rehabilitation of the Congo-Ocean Railway (CFCO), which was originally built in 1934 and connects the port to its capital, Brazzaville. The railway could drive the development of several mining projects along the line and facilitate access to markets in other landlocked countries in the region. Back in 2013, China Railway Construction Corporation (CRCC) signed an MoU with the Congolese government to modernize the CFCO under the Belt and Road Initiative framework, but the project still remains in the feasibility phase. Hopefully Wang Yi’s visit could pave the way for addressing the financing gap to ensure the actual completion of this project.

The second major African priority for this visit was industrialization, or value addition, especially for Nigeria, Congo, and Namibia. In 2023 and 2024 there was a large influx of Chinese investment into processing and refining minerals – including for construction goods such as cement and steel – a trend that is sent to intensify in 2025. China itself has significant drivers for outsourcing and diversifying its value chains, but African policies are also making a difference.

For instance, uranium dominates China-Namibia trade, In 2013, Swakop Uranium, primarily owned by China General Nuclear Power Corporation (CGNPC), initiated the development of the Husab uranium mine in Namibia. The project’s development cost was approximately $2.5 billion, making it one of China’s most substantial investments in Africa at that time. However, Namibia’s 2023 ban on exporting unprocessed lithium and other key minerals highlights a shift toward domestic processing and value addition. Namibia was keen to attract and encourage Chinese investments to align more with the country’s industrialization goals.

Nigeria too has been making this emphasis with China, especially in the context of aiming to transition from being a major importer of Chinese goods to becoming a more prominent exporter. Nigeria currently has a 13.5 to 1 trade deficit with China – especially since China does not feature in Nigeria’s top 10 oil export destinations. Attracting more investment from China in major manufacturing sectors will be critical to Nigeria’s plan to boost exports. While a range of Chinese companies are involved in the construction and operation of the high-profile Dangote Refinery, further cooperation could extend to fertilizer production and more. China’s Sinochem International has been involved in developing ammonia and urea production lines for Nigeria’s PFL Fertilizer Company, which aims to enhance the country’s agricultural output. Collaborative investments like the LAGRIDE initiative, a joint venture between the Lagos state government and CIG Motors, are set to improve Africa’s automotive industry by introducing e-mobility solutions, but linking this to actual manufacturing plants to supply e-vehicles in Nigeria and neighboring countries will be essential. Nigeria already has several special economic zones, including the China-invested Lekki SEZ, which will no doubt feature heavily in Nigeria’s investment promotion work with China in 2025.

Similarly, Congo already has four SEZs in Brazzaville, Pointe-Noire, Oyo-Ollombo, and Ouesso – with the Pointe-Noire SEZ particularly dedicated to more value-added manufacturing, including oil refining, chemical production, and mineral processing. It is already home to several key Sino-Congolese industrial cooperation projects, but again, Congo will have been hoping that Wang Yi’s visit – by promoting a Chinese government message of interest in African countries – could stimulate additional and deeper Chinese investments.

Last but not least, on the topic of trade, Namibia had some practical outcomes with China that it was seeking to advance, having kicked off in 2015 with a beef export agreement. By 2023, Namibia’s beef exports reached 59.9 million Namibia dollars (around US$3 million), reflecting a 19.8 percent year-on-year growth. Agreements on mutton and dried fruits were then made during President Nangolo Mbumba’s visit to China last September, and Namibia, like many others, will continue to push on these agreements in 2025, for instance in fishing and fresh fruit exports.

Certainly, amid global uncertainties, it was great to see China maintaining its diplomatic traditions with regard to African countries. Most countries now recognize the importance of African nations to their own development and foreign policy, but China has set the bar, with a regular yet diversified approach in its engagements across Africa, tailoring relationships to meet the unique needs of each partner. There is always room for improvement, and Chinese partnership does not come without its challenges. However, our view is this drive to diversify and innovate, combined with an active response to Africa’s evolving priorities, reinforces the resilience of Africa-China cooperation, and will precede a further uptick in practical outcomes in 2025.